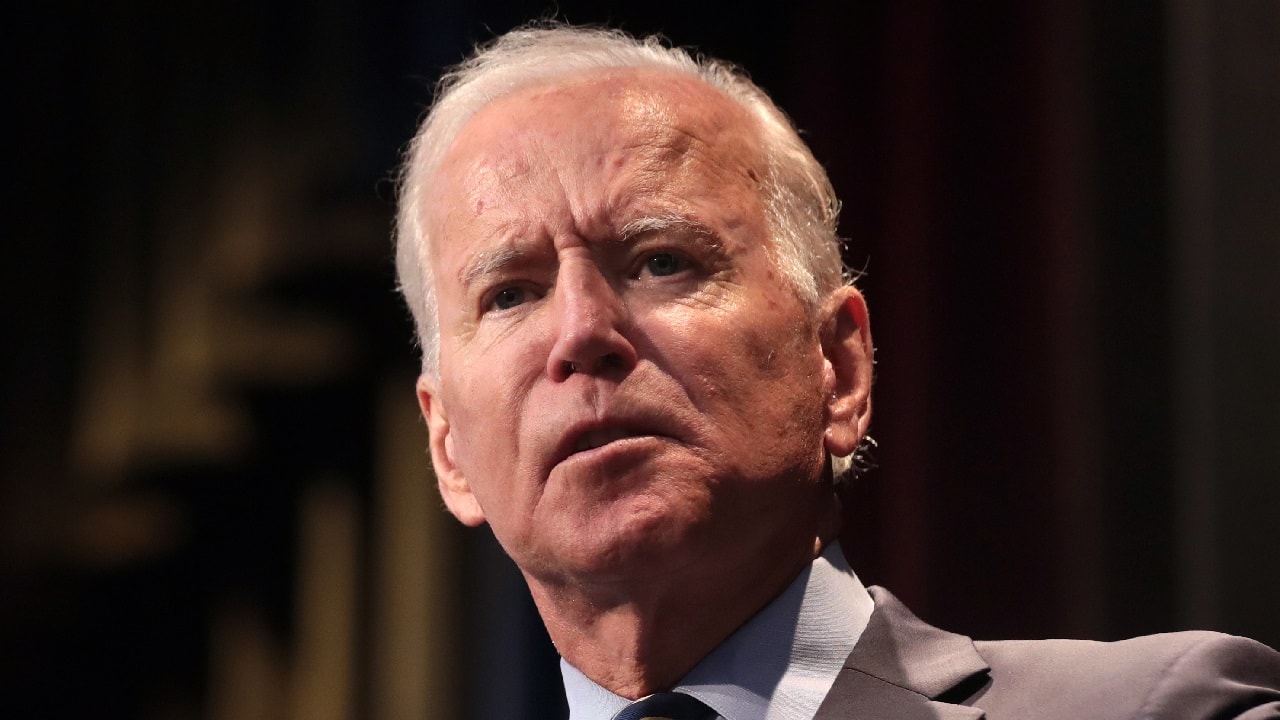

President Joe Biden’s latest budget proposal is dead in the water and will not pass the House and Senate, according to GOP lawmakers on Capitol Hill. Minority Leader Mitch McConnell said the Biden plan will not “see the light of day.”

Republicans hate the Biden budget because it reverses portions of the Trump-era 2017 tax cuts that so enthralled conservatives.

Big Savings By Taxing the Rich

The White House believes its budget can chop off nearly $3 trillion of the annual deficits over the next ten years. This will be partially accomplished by raising taxes on the wealthy. Specifically, Biden wants to tax billionaires who make over $100 million a year and raise the payroll tax on those who earn more than $400,000 a year to shore up Medicare.

Joe Biden May Have Winning Message on Taxes

Biden believes his tax proposals are a winner with Americans who think that the rich do not pay their share of taxes. Republicans hate any tax hikes because they could lead to even more taxation against the middle class as Democrats would maximize their wanton tax policies to hit all income groups.

Republicans Will Find Savings By Program Cuts

Republicans also want to cut discretionary spending, but they have not unveiled their own plan. This is spending that is aside from automatic expenditures on programs like Social Security and Medicare.

Liberals Finding Money By Closing Loopholes

Democrats have detailed proposals that find savings and more revenue that they are squeezing from numerous areas of the federal government. Medicare would have more ability to negotiate for lower prescription drug fees, for example. That could save $160 billion over ten years.

Other stipulations of the plan include:

-Improving the auction of the radio spectrum, which would grant $50 billion in more revenue.

-Cutting down on unemployment insurance fraud

-Making sure companies do not cheat on Medicaid, which would save $20 billion

-Ending subsidies to oil and natural gas firms – believed to make a $31 billion budget savings

-No longer supporting a tax break for real estate investors that would be worth $19 billion

-Closing loopholes on hedge fund tax avoidance

-Preventing billionaires from putting assets in IRAs to avoid taxes

-Ending tax subsidies for cryptocurrency transactions

Increasing the corporate tax rate to 28 percent

Democrats Fire First in Budget Battle

Senate Majority Leader Chuck Schumer believes that the Democrats have won half the battle by placing down a marker first. He thinks the Biden budget plan is a winner and challenges the Republicans to come up with their own budget-cutting proposals.

“Enough with the dodging, enough with the excuses,” Schumer said. “Show us your plan. And then show us how it’s going to get 218 votes on your side of the aisle.”

Race to Agree on Budget Ceiling Policy

It’s a good thing that Democrats and Republicans have started the budget process. The federal government runs out of funding authority this summer. Congress is forced to address the $31.4 trillion debt ceiling. A default would be disastrous to an economy that is smarting from inflation and high interest rates.

Democrats Want to Make Billionaires the Villains

Billionaires are often the enemy of Democrats who believe the one percent ultra-rich avoid paying a significant amount of taxes. Biden estimates there are 680 billionaires in the country who pay a lower percentage of taxes than middle-class households.

That may be true, but Republicans are afraid of any tax hikes that could stifle economic development being placed on job creators and innovative firms who took advantage of the 2017 tax cut policy during the Trump administration. Cutting corporate tax rates enables more funds to be repatriated from overseas and the resulting tax savings can be spent on capital investment that aids the U.S. manufacturing sector where more jobs can be produced.

Democrats are betting that the billionaire tax will play well in small towns and rural areas, including with union workers. The liberal media often covers Biden’s talking points that favor taxing the rich.

MORE: Hunter Biden Looks Doomed

MORE: Joe Biden: Too Old To Be President?

MORE: Kamala Harris Could Be Replaced?

MORE: Donald Trump Headed to Jail?

MORE: Joe Biden Keeps Breaking the Law

It will be interesting to see what Republicans want to cut that is different than the Democrats’ practice of closing loopholes. But the Democrats should be given credit for laying down a plan first and communicating to the American people they have answers. GOP lawmakers need to be more than obstructionists and show they have both fiscal restraint and new ideas when it comes to cost savings that will reduce budget deficits and debt.

Author Expertise and Experience:

Serving as 19FortyFive’s Defense and National Security Editor, Dr. Brent M. Eastwood is the author of Humans, Machines, and Data: Future Trends in Warfare. He is an Emerging Threats expert and former U.S. Army Infantry officer. You can follow him on Twitter @BMEastwood. He holds a Ph.D. in Political Science and Foreign Policy/ International Relations.