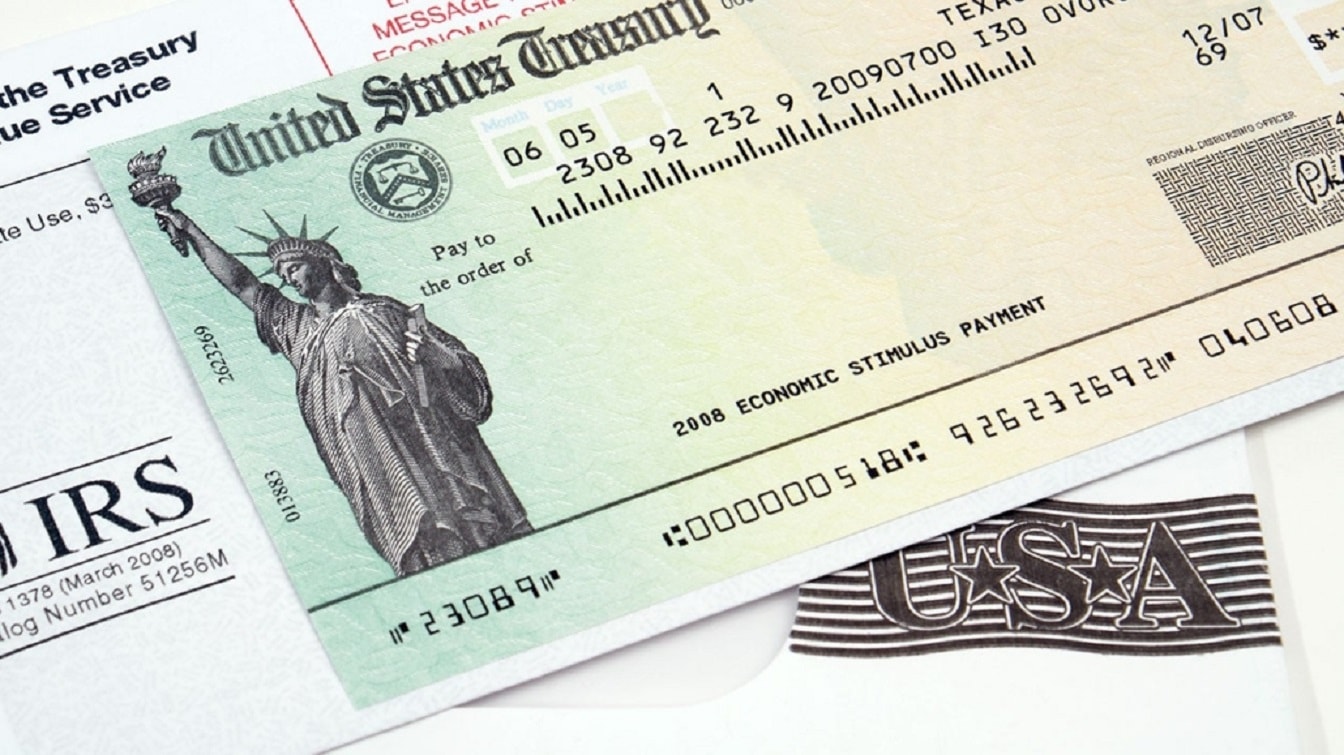

Welcome A Newborn In 2021? You Could Be Entitled to a $5,000 ‘Stimulus Check’: If you welcomed a new child to your family in 2021, you could be eligible to receive an additional $5,000 on your tax refund in 2022.

It comes as part of the $1.9 trillion American Rescue Plan package passed last year. It’s the same legislation that extended unemployment benefits to millions of American workers, implemented eviction moratoriums, and distributed $1,400 checks to every American.

Where Does the $5,000 Figure Come From?

The $5,000 figure is a combination of the next lump-sum payment of extended child tax credit – which may be worth up to $3,600 – as well as the $1,400 stimulus check for dependents. Most families have already received the $1,400 stimulus checks, but given that the checks are an advance of a tax credit from 2021, parents of newborns will only receive the credit after filing their tax returns this year.

How to Qualify for the Tax Refund

This quirk of the 2021 stimulus package has been known since it was first passed. Eligible parents will qualify for the additional stimulus check if their newborn child arrived before the end of 2021. They will also need to file the newborn child as a dependent on this year’s taxes.

To qualify for the additional $3,600 credit, parents will need to have children under the age of six. A single child under age 17 grants taxpayers a £3,000 credit, while having multiple children under six increases that to $3,600.

Parents filing individually must make under $75,000 per year to qualify for the credit, and heads of households must make less than $112,500. Parents who file jointly must make less than $150,000 per year combined.

Tax Refund Tip: File Your Taxes Early

In the annual National Taxpayer Advocate report, the customer service experience for American taxpayers during last year’s tax filing season was described as “horrendous.” The report also revealed how 6 million unprocessed individual tax returns were still backlogged by the end of December last year, with millions more unprocessed amended individual tax returns.

IRS Commissioner Chuck Rettig acknowledged the severe backlogs and recommended taxpayers file their taxes early and choose direct payments over checks to receive refunds as soon as possible. Rettig also announced that many tax refunds may take longer than the usual 21 days to be delivered.

Congress responded to the news by putting pressure on the IRS to deliver a plan of action to ensure that taxpayers receive their refunds as quickly as possible.

Jack Buckby is a British author, counter-extremism researcher, and journalist based in New York. Reporting on the U.K., Europe, and the U.S., he works to analyze and understand left-wing and right-wing radicalization, and report on Western governments’ approaches to the pressing issues of today. His books and research papers explore these themes and propose pragmatic solutions to our increasingly polarized society.