John F. Kennedy was fond of repeating the wise old saying that success has a hundred fathers but failure is an orphan. If ever there was an area where this adage has applicability, it has to be in the field of economic policy.

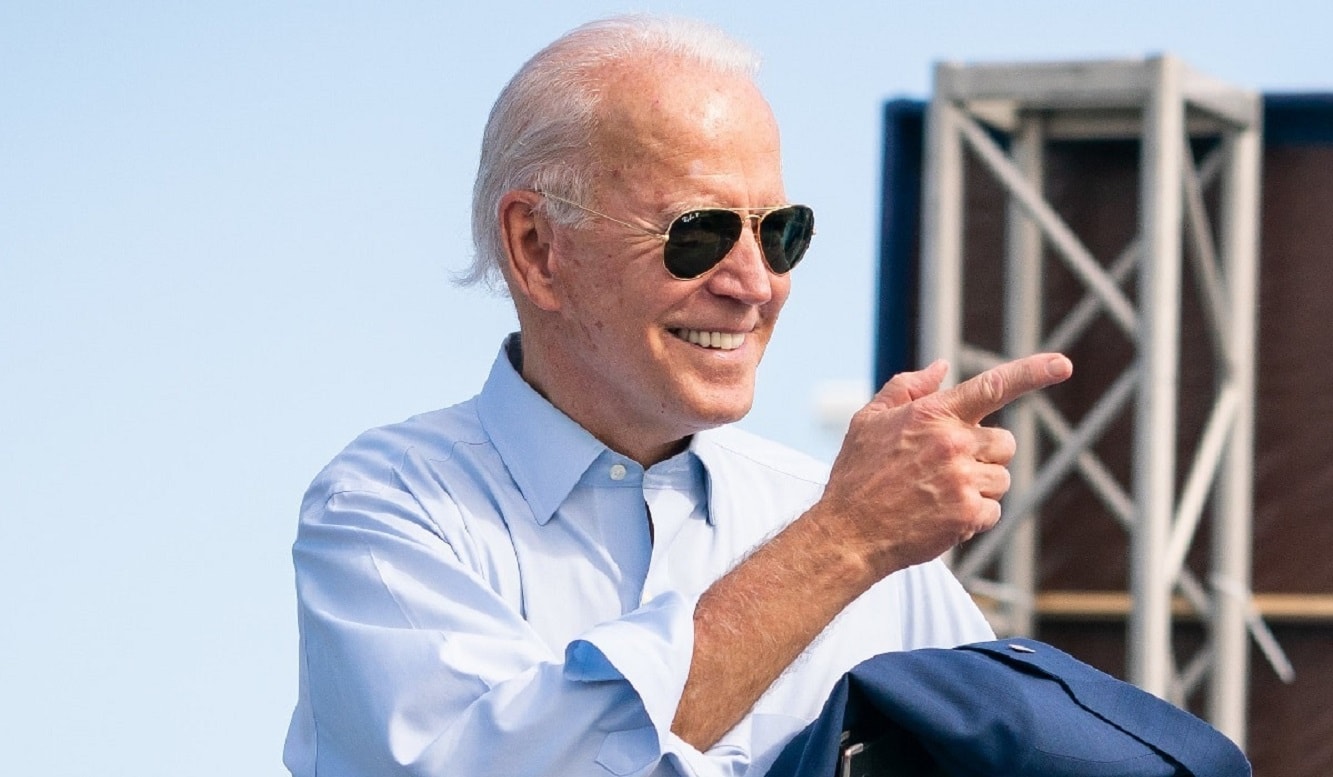

Today’s welcomely benign inflation numbers will offer a clear example of how economic success has a hundred fathers. We can be sure that President Biden will claim that the sharp reduction in headline inflation from a multi-decade high of 9 percent last June to today’s 3 percent has been the result of Bidenomics in general and the Inflation Reduction Act in particular. He will see today’s numbers as a gift to his re-election bid. Those numbers will bolster Mr. Biden’s hopes that he can get a skeptical American public to start believing in the supposed wonders of Bidenomics

Not to be outdone, Federal Reserve Chairman Jerome Powell is sure to claim that inflation’s welcome decline has been the result of the Fed’s brilliant monetary policy tightening under his watch. He will intimate that a soft economic landing might be in sight thanks to the Fed’s bold monetary policy management. After all, did the Fed not raise interest rates over the past year by 5 percentage points or at the fastest pace since the early 1980s? Also, did not the Fed shift from an aggressive policy of flooding the market with liquidity through its bond buying activities in 2020-2021 to one of withdrawing $95 billion a month in liquidity over the past year by not rolling over its bond holdings as they mature?

By contrast, last year’s inflation surge, which caught our economic policy makers totally flatfooted, was an orphan. Rather than assuming any responsibility for one of the largest economic policy failures in decades, both Mr. Biden and Mr. Powell were quick to find reasons for inflation’s surge that notably excluded their own egregious policy mistakes. These reasons included the Covid pandemic with its associated global supply chain disruptions and Russia’s Ukraine invasion, which drove the price of food and oil through the stratosphere.

In Mr. Biden’s view, his overly expansive budget policy had nothing to do with inflation’s surge. Never mind that in March 2021, at a time when the economy was already well on its way to recovery, Mr. Biden got Congress to pass the $1.9 trillion American Rescue Plan. That stimulus came on top of $3 trillion in bipartisan Covid relief stimulus the previous year. This meant that in the two years 2020 and 2021, the US economy received a budget stimulus in the staggering amount of some $5 trillion or more than 20 percent of GDP. Little wonder that former Treasury Secretary Larry Summers characterized this as “the least responsible” budget policy in the last forty years and correctly anticipated that the economy would overheat.

For his part, Mr. Powell keeps insisting that inflation’s surge had nothing to do with the Fed’s ultra-loose monetary policy. Never mind that at a time when the economy was well on its way to recovery from the Covid-induced recession and was receiving its largest peacetime budget stimulus on record, the Fed chose to keep interest rates at their zero-lower bound till March 2022. Never mind too that the Fed kept flooding the market with liquidity through its Quantitative Easing policy and allowed the broad money supply to balloon by a staggering 40 percent over a two-year period.

Even though the economy is now slowing and even though the recent contraction in the broad money supply has often been the harbinger of a recession, the jury is still out whether the economy will soon experience a hard economic landing. However, of one thing we can be sure. Neither Mr. Biden nor Mr. Powell will assume any responsibility for the overheated economy and the inflation surge last year that all too likely has set us up for an economic recession.

Desmond Lachman is a senior fellow at the American Enterprise Institute. He was a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging market economic strategist at Salomon Smith Barney.

From 19FortyFive

Donald Trump Just Proved How Stupid He Is