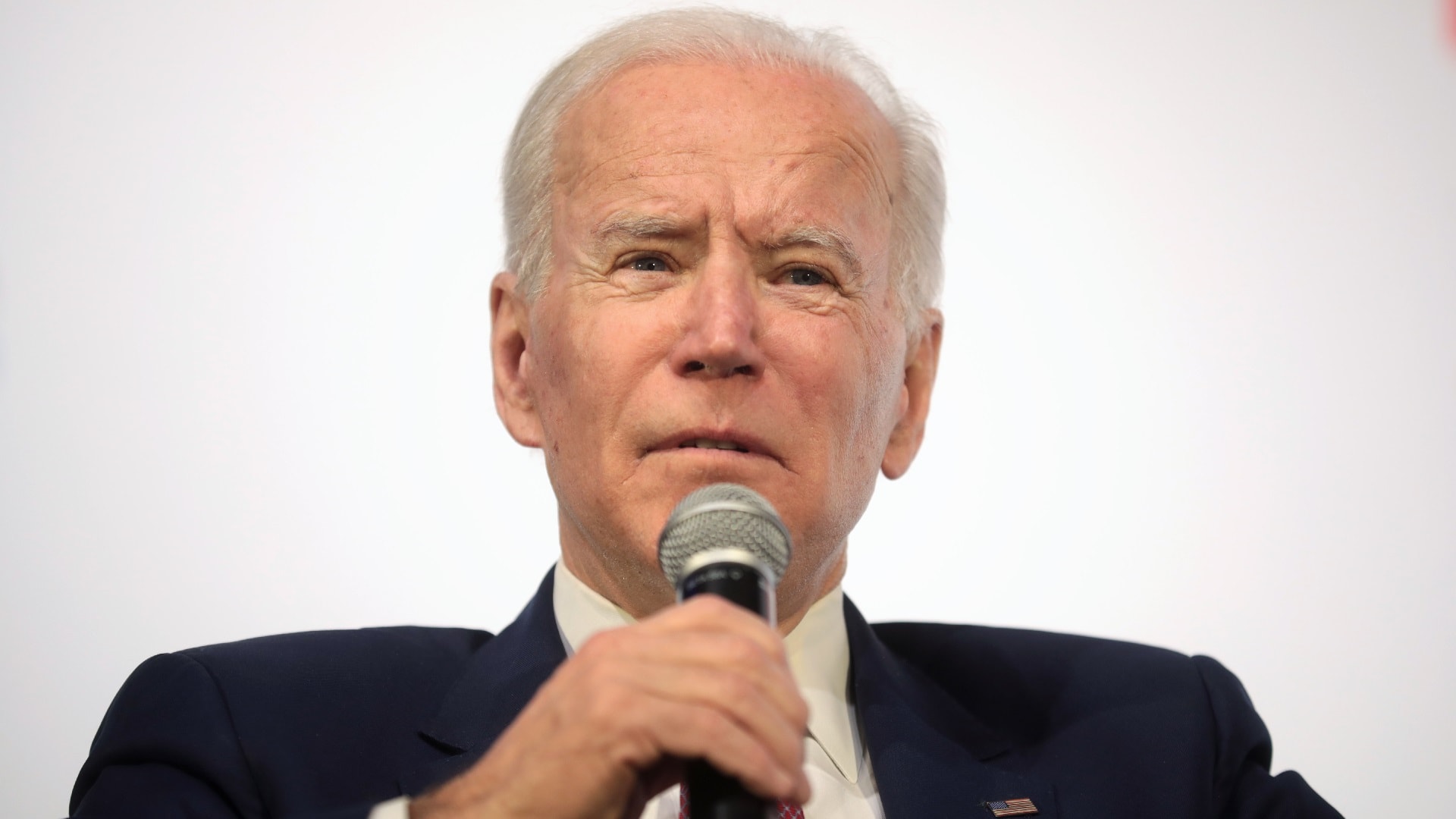

When President Joe Biden signed the Inflation Reduction Act (IRA) in 2021, one provision was a large new amount of funding for the IRS. This was pitched by Democrats as a way to make up for years of underfunding, while also stepping up tax enforcement.

Funding an IRS “Army”

In the Republican imagination, however, the new IRS funding was for “87,000 new IRS agents,” or possibly “an army of 87,000 new IRS agents,” In some versions, the 87,000 IRS agents are “armed.”

There’s no truth to the 87,000 figure. The origin is a Treasury Department report from several years ago, which found that if the amount of money asked for by the Treasury for the IRS was passed, it would allow the agency to hire 87,000 people over a decade-long period. Those 87,000 people would not all be agents, would not all be “armed,” nor would they all be hired at once.

“The IRS has about 79,000 employees, down from about 95,000 in fiscal year 2012,” the Washington Post wrote in an explainer last year. “But the new hiring does not mean the agency’s staff will double, as some Republicans claimed during debate on the legislation.”

When Republicans took over the House earlier this year, they held some votes, including one to abolish the IRS altogether, although those votes never had any hope of passing. The House did pass a bill rescinding the Inflation Reduction Act’s new IRS funding, but the bill did not have any chance in the Democratic-controlled Senate.

New Speaker, New Proposals

Now, under new Speaker Mike Johnson, Republicans have proposed more IRS reductions, in exchange for aid to Israel.

According to NBC News, the House GOP has proposed cutting $14.3 billion from the IRS funding, while directing the same amount of money as aid to Israel.

However, that doesn’t mean that the reductions will become law.

“If the bill passes the GOP-controlled House, the IRS provisions are all but guaranteed to be rejected by the Democratic-led Senate and White House, setting up a clash over how to approve Israel aid,” NBC News reported. “It represents an early test for Johnson on navigating the demands of Republican hard-liners with the realities of divided government.”

This all lines up as a deadline approaches for the parties to avoid a government shutdown, as Congress must consider aid to Israel as well as to Ukraine. The White House has sought to couple the two.

“I understand their priority is to bulk up the IRS, but I think if you put this to the American people and they weigh the two needs, I think they’re going to say standing with Israel and protecting the innocent over there is in our national interest and is a more immediate need than IRS agents,” the new speaker told Fox News this week.

Columnist Jonathan Chait, in New York magazine, argued against the gambit, which is much more likely meant as a messaging gimmick than as something that will ever become law.

“Cutting IRS funding does not avoid bankrupting our country. In fact, it hastens it. IRS funding is used to increase collection of tax payments. In theory, the IRS could be funded so lavishly that additional funding does not yield any net tax revenue, but reality is nowhere close to this level,” Chait writes, adding that the GOP resolution also includes a provision that the budgetary effect of the change “shall not be estimated.”

“Research suggests that every additional dollar in IRS funding yields many times more dollars in revenue, through both direct enforcement and by deterring fraud. One recent paper estimates that a dollar of funding yields $12 in revenue.” Greater enforcement, after all, is meant to yield higher tax revenue.

Author Expertise and Experience:

Stephen Silver is a Senior Editor for 19FortyFive. He is an award-winning journalist, essayist and film critic, who is also a contributor to the Philadelphia Inquirer, the Jewish Telegraphic Agency, Broad Street Review and Splice Today. The co-founder of the Philadelphia Film Critics Circle, Stephen lives in suburban Philadelphia with his wife and two sons. Stephen has authored thousands of articles over the years that focus on politics, technology, and the economy for over a decade. Follow him on X (formerly Twitter) at @StephenSilver, and subscribe to his Substack newsletter.