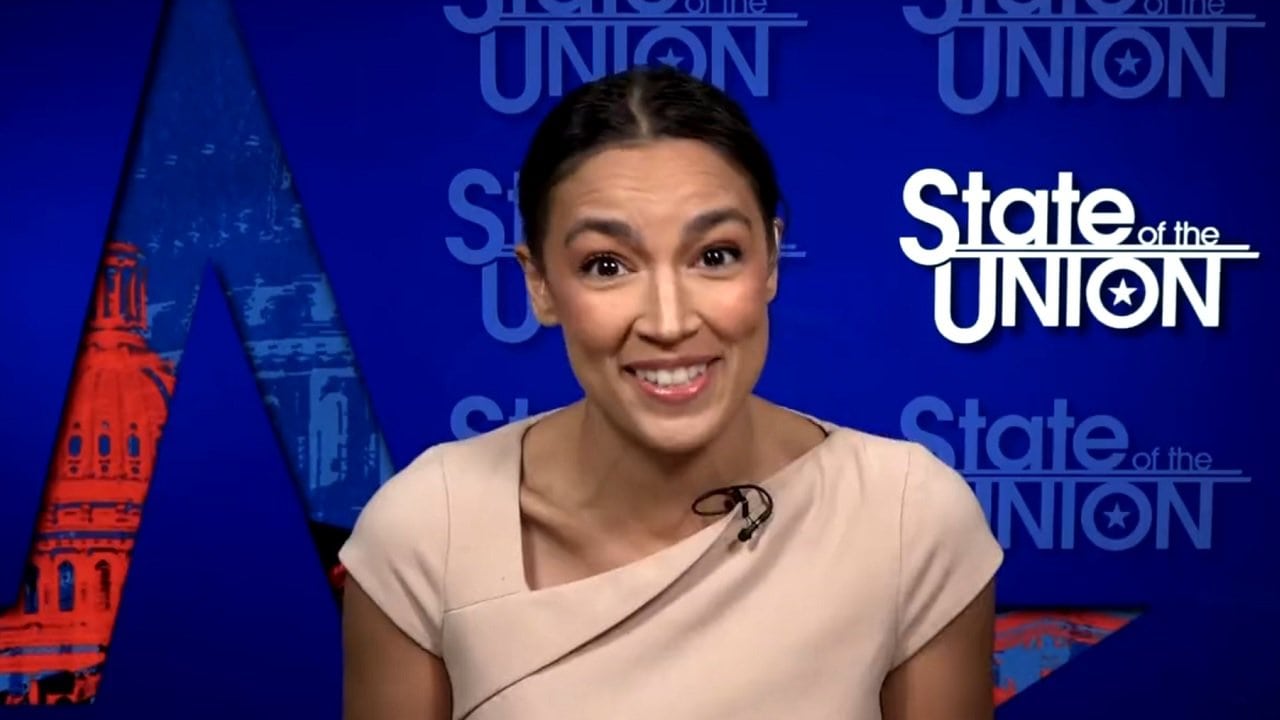

The AOC has made a tax proposal that stands no chance of being enacted in the current Congress: If there are two things the Wall Street Journal opinion page is known for, it’s opposing tax cuts for the rich, and arguing that rich people aren’t rich. The newspaper did both this week in a story about Rep. Alexandria Ocasio-Cortez (D-NY) and her proposal to raise taxes on New York households earning over $250,000 a year.

What is AOC Doing?

The op-ed, by Empire Center for Public Policy CEO Tim Hoefer, states that “New York socialists calling for higher taxes aim to spread the tax net far beyond Wall Street, scooping up folks on Main Street—especially in the suburbs.”

“The top 1% of New Yorkers begins just south of $1 million in adjusted gross income. But the top 5% begins a little above $250,000—translating into married couples making $127,000 each,” the WSJ op-ed says. “More than 168,000 New York state and local government employees were paid more than $127,000 last year. Forty-five New York school districts paid most of their teachers and administrators at least that much, and about 70 police or fire departments had mean pay above that line.”

The source of this is a press release from the New York City Democratic Socialists organization, which is signed by 20 elected officials who call themselves socialist, including Rep. Ocasio-Cortez, State Senator Julia Salazar, and Councilmember Tiffany Cabán, as well as other state and county legislators from different parts of New York.

The statement, dated September 18, rips the Democratic Governor and Mayor of New York, Kathy Hochul and Eric Adams, for their “policy proposals and rhetoric towards asylum seekers.” The signatories ask to stop “violent budget cuts,” to utilize the state’s “economic uncertainties” and enforce the state’s Right to Shelter. They also call for comprehensive immigration reform.

The letter makes several proposals, most of which don’t involve tax policy, although one paragraph touches on the taxation proposal.

“The vast majority of us have felt the strain of rising prices from the grocery aisle to the housing market,” the statement says. “Meanwhile, the richest New Yorkers have grown their wealth since the pandemic, and it’s past time they pay their fair share. Along with real housing solutions, socialists in office have been fighting for full funding of schools, higher education, and healthcare. We can pay for these public services by raising taxes on the top 5% of New Yorkers.”

That last proposal links to a website called TaxtheRichNY.com, which is a project of the Democratic Socialists of America (DSA) and its New York chapter. It includes detailed proposals about the taxation policies, including specific bills that the group endorses.

“Why Tax the Rich? Well, New Yorkers work hard,” the website says. “To provide for our families. To help our friends. To take care of our neighbors. To build a future we’d be proud to watch the next generation grow up in.”

There are a couple of things worth noting here. One, the headline and lede of the Wall Street Journal op-ed tie the proposal to the Congresswoman known as AOC, but all she did was sign a letter. The policies are proposed at the state level in New York, and not nationally, and Ocasio-Cortez is a member of Congress, not able to sponsor or introduce legislation in New York.

And perhaps more importantly, this legislation is highly unlikely to become law.

The Democratic governor of New York, the WSJ op-ed notes, “has thus far resisted this and other calls for economically destructive tax hikes, even as she grapples with looming budget shortfalls.” Indeed, while avowed socialists have more of a foothold in state government in New York than they do in most of the rest of the country, they do not comprise anything close to a legislative majority.

So the proposed new tax on those making over $250,000 is probably not going to go into effect.

Author Expertise and Experience

Stephen Silver is a Senior Editor for 19FortyFive. He is an award-winning journalist, essayist and film critic, who is also a contributor to the Philadelphia Inquirer, the Jewish Telegraphic Agency, Broad Street Review and Splice Today. The co-founder of the Philadelphia Film Critics Circle, Stephen lives in suburban Philadelphia with his wife and two sons. Stephen has authored thousands of articles over the years that focus on politics, technology, and the economy for over a decade. Follow him on X (formerly Twitter) at @StephenSilver, and subscribe to his Substack newsletter.

From the Vault