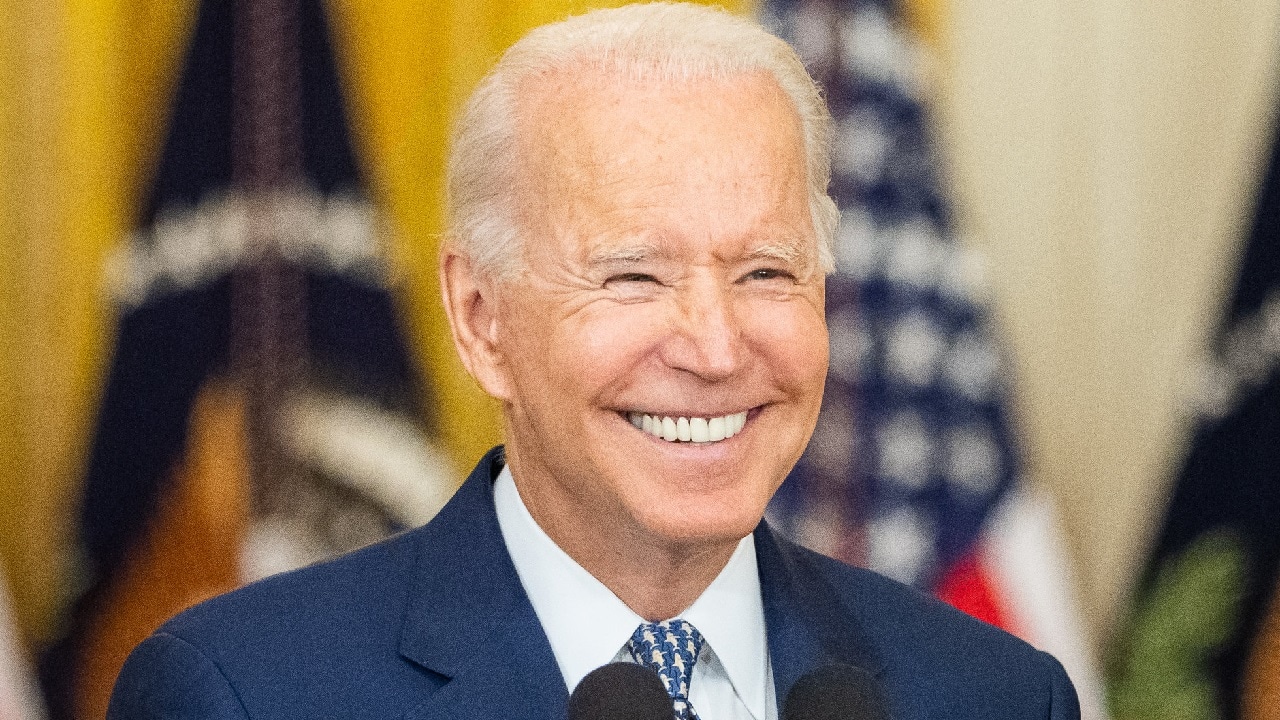

Joe Biden is looking for ways to reduce student debt in the wake of the U.S. Supreme Court’s finding in June that he lacked statutory authority to cancel $400 billion in student debt owed by 43 million Americans.

“This kind of relief is life-changing for individuals and their families, but it’s good for our economy as well. By freeing millions of Americans from the crushing burden of student debt, it means they can go and get their lives in order,” Biden said according to CNN.

“They can think about buying a house, they can start a business, they can be starting a family. This matters, it matters to their daily lives,” he added.

This announcement comes as 28 million borrowers resume payments for the first time since the start of the pandemic. The Consumer Financial Protection Bureau warned in June that 1 in 5 borrowers could have trouble making their payments. These borrowers also find themselves deep in credit cards and other debts.

“Resuming student loan payments without cancellation will lead to unprecedented delinquencies and defaults for the most financially vulnerable borrowers,” said Persis Yu, deputy executive director at the Student Borrower Protection Center.

Biden Administration Expands Loan Forgiveness

The Biden administration announced plans Wednesday to add an additional 125,000 Americans to receive $9 billion in debt relief through income-driven repayment (IDR) and Public Service Loan Forgiveness (PSLF). It grants automatic relief to borrowers with total and permanent disabilities.

The Department of Education notes that $5.2 billion in additional debt relief will become available for 53,000 borrowers under Public Service Loan Forgiveness programs. Fifty-one thousand borrowers will obtain $2.8 billion in relief through fixes to income-driven repayment plans. Such borrowers have been paying for 20 years or more and never received the relief they were entitled to.

“For years, millions of eligible borrowers were unable to access the student debt relief they qualified for, but that’s all changed thanks to President Biden and this Administration’s relentless efforts to fix the broken student loan system,” Education Secretary Miguel Cardona said in a statement. “The Biden-Harris administration’s laser-like focus on reducing red tape, addressing past administrative failures, and putting borrowers first have now resulted in a historic $127 billion in debt relief approved for nearly 3.6 million borrowers.”

Cardona continued, “Today’s announcement builds on everything our administration has already done to protect students from unaffordable debt, make repayment more affordable, and ensure that investments in higher education pay off for students and working families.”

The Biden administration claims it has approved $127 billion for 3.6 million borrowers.

The Washington Post reports that 855,000 borrowers are eligible for $42 billion in loan cancellation through income-driven repayment programs.

“I am heartened to see these programs begin to deliver relief for these borrowers,” said Persis Yu, deputy executive director at the Student Borrower Protection Center, told The Washington Post. “Just a couple of years ago, the number of borrowers who had their debts canceled under IDR was only 32. The fact that that number grew by more than 50,000 in just two months is incredible.”

Liberals Want More Action

Liberal activists want Biden to still do more.

“If the Department of Education can cancel this amount, it can cancel it all — meeting and exceeding the president’s commitment to borrowers currently being crushed by the chaotic return to repayment,” Astra Taylor, co-founder of the Debt Collective, a union for debtors told CNBC.

John Rossomando is a defense and counterterrorism analyst and served as Senior Analyst for Counterterrorism at The Investigative Project on Terrorism for eight years. His work has been featured in numerous publications such as The American Thinker, The National Interest, National Review Online, Daily Wire, Red Alert Politics, CNSNews.com, The Daily Caller, Human Events, Newsmax, The American Spectator, TownHall.com, and Crisis Magazine. He also served as senior managing editor of The Bulletin, a 100,000-circulation daily newspaper in Philadelphia, and received the Pennsylvania Associated Press Managing Editors first-place award for his reporting.