The Congressional Budget Office (CBO) released an analysis of the infrastructure bill that is winding its way through Capitol Hill. The Committee for a Responsible Federal Budget (CRFB) summarizes the CBO report here. CBO found that the bill would increase federal deficits, but the more important problem is that the spending itself is harmful and unneeded.

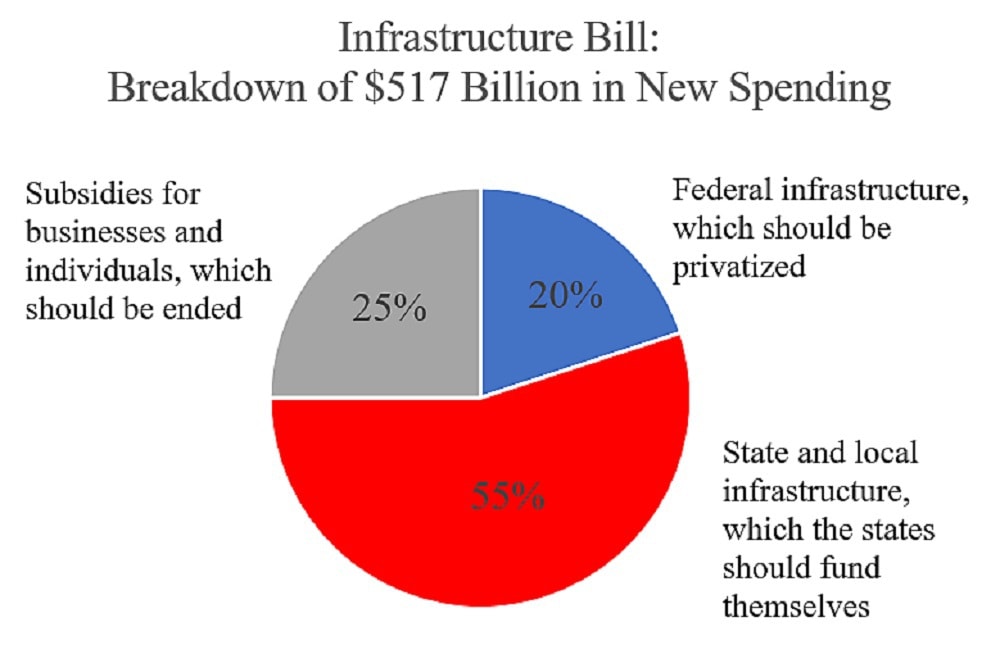

CRFB finds that the infrastructure bill would increase gross outlays by $517 billion over the coming decade, based on the CBO data. The CRFB and CBO examine the spending by activity, such as highways, transit, and broadband. But I’ve reorganized the spending into three buckets as follows:

Federal. The bill would increase spending about $101 billion on federal infrastructure, such as Amtrak and water facilities. I have argued that these and other federal assets should be privatized and self‐funded.

State‐Local. The bill would increase spending about $287 billion on state and local infrastructure, including highways, transit, airports, and local water systems. But the states can and should fund their own infrastructure, especially now that they are enjoying a gusher of revenues.

Private. The bill would increase spending about $129 billion on subsidies for businesses and individuals, including for electricity, broadband, EV charging, and renewable energy. This spending would intensify corporate lobbying and political corruption in Washington.

America would have more efficient investment and operation of infrastructure if the federal government ended subsidies to the states and private sector and all three levels of government privatized assets that could be supported by user charges.

The chart summarizes the proposed new infrastructure spending. The categorization into the three buckets is a rough first take.

Chris Edwards is the director of tax policy studies at Cato and editor of DownsizingGovernment.org. He is a top expert on federal and state tax and budget issues. Before joining Cato, Edwards was a senior economist on the congressional Joint Economic Committee, a manager with PricewaterhouseCoopers, and an economist with the Tax Foundation.