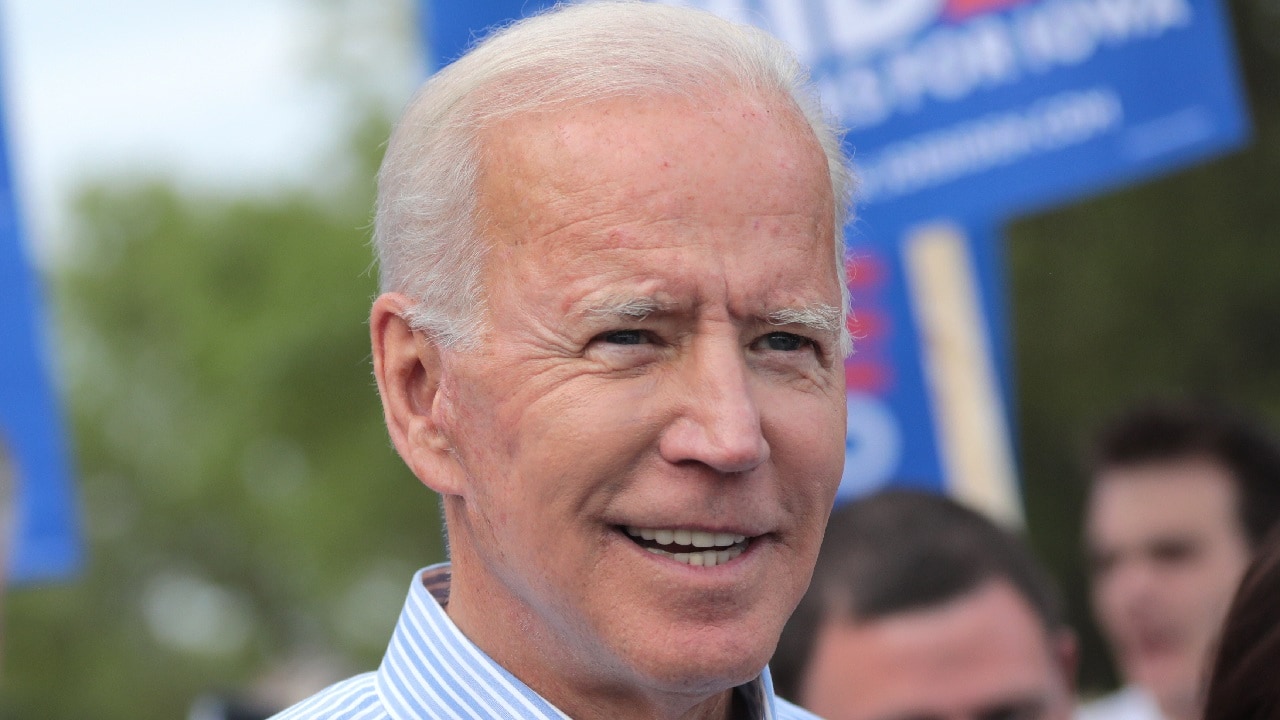

The deficit has been less of a contentious political issue during the Joe Biden presidency than during some others. But the president has come up with a plan to reduce it.

The politics of the deficit and the national debt are often very strange. The national debt, for the most part, always rises, while the deficit tends to rise and fall, largely depending on economic conditions, or on whether there’s any kind of major crisis (like the 2008 economic crash or COVID-19) that requires massive, sudden government expenditures.

Often, the deficit has disappeared as a political issue during Republican presidencies, only to suddenly re-emerge again once a Democrat is in office, especially if Republicans are in control of Congress. This is the case currently, with new House Speaker Kevin McCarthy calling for the “elimination” of budget deficits in the upcoming debt ceiling talks.

Meanwhile, figures in both parties have said in the past that deficits aren’t worth worrying about. Then-Vice President Dick Cheney once said “Reagan proved deficits don’t matter.” There’s an entire, albeit controversial, the body of thought on the left, known as Modern Monetary Theory, which argues, among other things, that everything you think you know about deficits is wrong.

Now, a report says President Joe Biden has a plan for deficit reduction.

According to Axios, Biden “plans to make deficit reduction a centerpiece of his 2024 budget and aims to pressure Republicans to focus on government revenue — not just spending.”

What does Joe Biden’s budget plan propose?

“The White House is seeking a tactical advantage in its looming showdown with congressional Republicans on the debt limit — and wants to test Republicans’ commitment to lowering annual deficits over the next decade.”

The president plans to propose tax increases on wealthy people and corporations, while also claiming $238 million in deficit reduction from the Inflation Reduction Act, which passed last year. He also plans to “slow the rate of growth” for some programs.

“Instead of cutting the number of audits of wealthy taxpayers, I signed a law that will reduce the deficit by $114 billion by cracking down on wealthy tax cheats,” the president said earlier this week in his State of the Union address, per the White House’s transcript. “In the last two years, my administration cut the deficit by more than $1.7 trillion – the largest deficit reduction in American history.”

That claim about deficit reduction is technically true, although it has more to do with the expiration of massive amounts of COVID-era aid than with anything else.

Elsewhere in the speech, Joe Biden said that he will offer his “fiscal plan” next month, which “will lower the deficit by $2 trillion,” without cutting Social Security or Medicare.

The Hill reported earlier this month that Biden will introduce his budget on March 9, with an eye towards encouraging House Republicans to release their own budget proposal and let voters compare the two.

It’s important to note when discussing budget talks, that the “president’s proposed budget” is not, for all intents and purposes, real, and that is the case across essentially all presidencies. The budget is merely a messaging document that will not be signed into law as is, and everyone involved with the process knows this. This was also true of former Rep. Paul Ryan’s “Path to Prosperity” budget, which was much more of a messaging document than something meant actually to become law.

At best, the president’s budget represents the first offer by the White House in budget negotiations with Congress. The House, under Republican leadership, will not be agreeing to the tax increases that Biden proposes and will almost certainly call for greater spending cuts.

As is nearly always the case, the actual budget that passes will end up being a compromise between the parties, often in the form of a continuing resolution that prevents a government shutdown and keeps the government funded for some period of time.

BONUS: The Fall of Joe Biden Has Started

BONUS: Donald Trump Looks At His End

BONUS: Kamala Harris Should Quit

Expertise and Experience: Stephen Silver is a Senior Editor for 19FortyFive. He is an award-winning journalist, essayist and film critic, who is also a contributor to the Philadelphia Inquirer, the Jewish Telegraphic Agency, Broad Street Review and Splice Today. The co-founder of the Philadelphia Film Critics Circle, Stephen lives in suburban Philadelphia with his wife and two sons. Follow him on Twitter at @StephenSilver.