Nero is said to have fiddled while Rome burned. Today, it seems that Washington’s politicians prefer to play games with the debt ceiling. They do so at a time when the country could soon default on its debt and when the country’s public finances seem to have gone from bad to worse.

Advisory on the Debt Ceiling

Yesterday, the non-partisan Congressional Budget Office (CBO) indicated that the United States could hit the debt ceiling anywhere between July and September. Failure to raise the debt ceiling by that time would result in the U.S. government, the world’s largest sovereign debtor, defaulting on its debt.

That is the last thing that the U.S. and world economies need at a time when high-interest rates are already raising the risk of a U.S. and world economic recession and when U.S. and global financial markets are already on the back foot.

Threat to Financial Markets Worldwide

As we should have learned from the 2011 U.S. debt ceiling battle, financial markets can become highly unsettled if the debt negotiations go down to the wire. It could also result in further credit downgrading by the rating agencies. That was the case in 2011, even though in the end a debt default was avoided. Needless to add, if this time around the U.S. government were actually to default on its debt obligations, all hell would break loose in world financial markets as the creditworthiness of the world’s largest government debtor would be placed in question.

Heightening the risk of financial market turbulence today in the event of a protracted debt ceiling negotiation standoff is the fact that our public finances are in a parlous state. According to the CBO’s latest estimates, on present budget trends through 2028, our public debt to GDP ratio will reach an all-time record and by 2033 it will be close to 120 percent. Meanwhile, all three major federal trust funds – the Highway Trust Fund, Medicare Hospital Insurance, and Social Security Old-Age and Survivors Insurance – will be exhausted within the next decade.

Party Battle Lines

A principal reason why our public finances are in their present parlous state is that there has been no political constituency for budget responsibility. When the Republicans have been in control of the White House and Congress, they have pushed for large tax cuts without making corresponding spending cuts. Similarly, when the Democrats have been in charge, they have pushed for large public spending increases without pushing for tax increases that might fund those expenditures.

Instead of pushing for real budget reform that might put our public finances on a sounder footing and that thereby might safeguard our children’s economic and financial future, our politicians seem to be leading us toward another dangerous game of debt-ceiling chicken later this summer. House Speaker Kevin McCarthy keeps insisting that the Republicans will not agree to raise the debt ceiling without deep cuts in public spending.

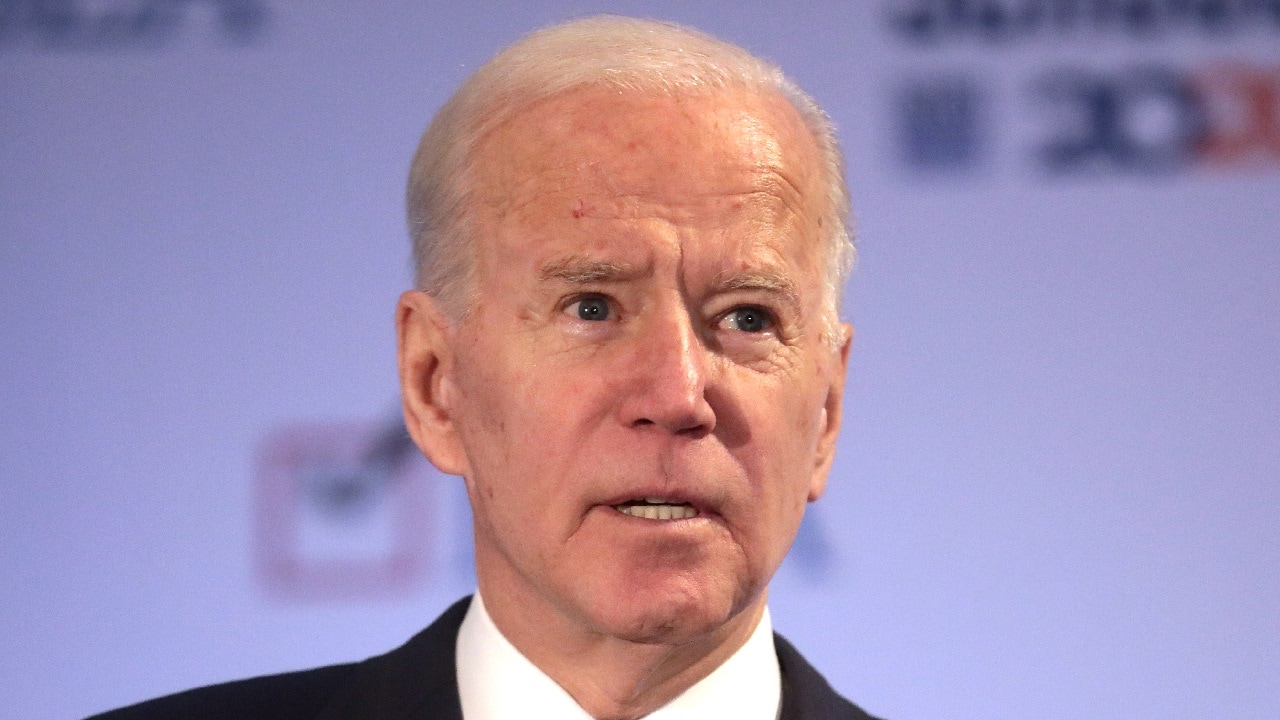

For his part, President Joe Biden keeps insisting that he will not negotiate on the debt ceiling. In his view, the debt ceiling should automatically be raised as has been done many times before to allow the government to fund the expenditures that Congress has already approved.

In 2010, President Obama established a bipartisan National Commission on Fiscal Responsibility and Reform. Headed by Erskine Bowles and Alan Simpson, that commission was tasked with coming up with sensible solutions to the country’s fiscal problems. Sadly, the commission’s sensible proposals for budget reform were largely shelved.

If ever the country needed sensible budget reform it has to be now. Instead of engaging in a potentially damaging debt ceiling negotiation standoff, politicians on both sides of the aisle would do well not only to throw their support behind a new bipartisan budget reform commission but also to act on that commission’s recommendations. However, in today’s polarized political climate, I would now suggest holding your breath for that to happen.

Author Expertise and Experience:

Dr. Desmond Lachman joined AEI after serving as a managing director and chief emerging market economic strategist at Salomon Smith Barney. He previously served as deputy director in the International Monetary Fund’s (IMF) Policy Development and Review Department and was active in staff formulation of IMF policies. Mr. Lachman has written extensively on the global economic crisis, the U.S. housing market bust, the U.S. dollar, and the strains in the euro area. At AEI, Mr. Lachman is focused on the global macroeconomy, global currency issues, and the multilateral lending agencies.