A character in Ernest Hemingway’s first novel, “The Sun Also Rises,” explains how he went bankrupt: “Gradually and then suddenly.”

Americans who have fallen deep into credit card debt or had to rely on high-interest, payday loans probably can relate.

As a borrower’s debt mounts and his credit score is downgraded, creditors demand higher and higher interest rates for additional lending. It’s like you’re gradually drifting down the river and as you approach the rapids ahead, the current suddenly accelerates.

The Congressional Budget Office’s annual budget outlook shows that when it comes to the nation’s finances, the current is starting to pick up.

The budget office—commonly known as the CBO—can’t predict exactly how long we have before we hit the rapids or go over the falls. But the CBO report offers a clear warning that it’s time to do the hard work of rowing back upstream.

If the federal government keeps going with the flow, at some point we’re in for a painful plunge in the form of a catastrophic debt or financial crisis.

When it becomes clear that the nation’s debt is spiraling out of control with no plans to turn things around, investors eventually will lose faith in U.S. debt as a safe asset. Ever higher interest rates will be necessary to entice investors, drowning the nation’s finances and the economy under a sea of debt.

What follows are seven eye-poppingly alarming budget milestones that CBO says await us under the hopeful assumption that interest rates remain basically unchanged over 30 years.

Since the start of the pandemic, CBO’s interest rate assumptions have been optimistic at best; last year, the agency underestimated interest costs for fiscal year 2022 by $76 billion. If interest rates continue to spike, things will go south much more quickly than CBO’s latest forecast suggests.

2023: Forecast Interest Payments Jump 45%

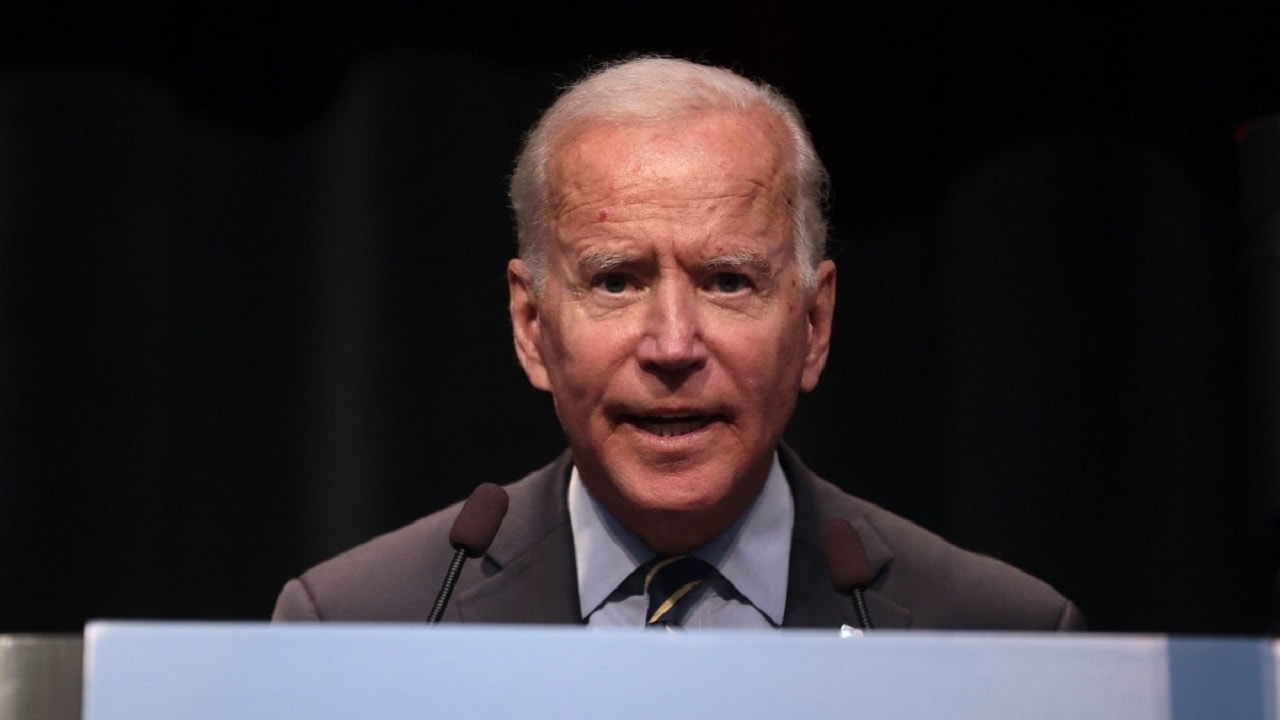

One of the most troubling things about the latest Congressional Budget Office forecast on President Joe Biden’s watch is how much the budget situation has deteriorated compared to last year’s forecast, released in May.

Last year, CBO projected that 2023 net interest payments would total $442 billion. It’s been less than a year, and now CBO expects that annual interest payments for 2023 will be about $200 billion higher, at $640 billion. That 45% correction is mostly the result of rapidly rising interest rates since last year.

Even if interest rates rise no further than they already have—which CBO optimistically forecasts—net interest payments would continue to soar because over time a growing share of currently outstanding Treasurys (securities sold by the federal government to investors) must be issued at the new high rates.

2026: Americans Face Across-the-Board Tax Hikes

The Congressional Budget Office assumes that the scheduled expiration of the 2017 Tax Cuts and Jobs Act will occur, and beginning Jan. 1, 2026, Americans across all income groups will face a multitrillion-dollar tax increase.

Tax rates would rise on individuals across the board, and the standard deduction would be cut in half.

The looming tax hike would be painful for American families who already are being squeezed economically. But it wouldn’t meaningfully improve America’s debt situation.

Our overspending would continue plunging us toward a debt crisis, as the CBO milestones below demonstrate. However, we’d enter the debt crisis more overtaxed and economically weakened.

Our fiscal problems can’t be solved with more taxes.

2027: Debt’s Portion of GDP Triples in 20 Years

The Congressional Budget Office report also shows that the federal debt held by the public will rise to roughly 105% of gross domestic product in 2027.

That means the debt will be about three times larger as a share of the economy than it was in 2007, when the debt-to-GDP ratio was a “mere” 35% of GDP. Over that 20-year period, the debt will have grown about eight times faster than the economy.

2028: Annual Interest on Debt Hits $1 Trillion, Surpassing Defense Spending

Annual net interest payments, which totaled $352 billion in 2021, will soar to about $1 trillion in 2028, according to the Congressional Budget Office.

For the first time, the government will spend more on interest payments—a whopping 13% of federal outlays—than on the nation’s defense.

In fact, the government will spend more as a share of the overall economy on interest payments to service the debt (3.1%) than was spent on the entire federal government a century before (3%).

By this point, Social Security, Medicare, and net interest will consume 52% of federal outlays, leaving lawmakers with a difficult path to fiscal sustainability.

2032-2033: Medicare, Social Security Become Insolvent

The Social Security trust fund will be fully depleted in 2032, according to the Congressional Budget Office.

Once the Social Security trust fund is exhausted, if lawmakers do nothing, beneficiaries would face 23% across-the-board cuts in benefits.

Similarly, CBO projects that the Medicare Hospital Insurance trust fund will be exhausted in 2033.

In separate forecasts, the trustees of the Social Security and Medicare trust funds estimate that the programs will reach insolvency in 2034 and 2028, respectively.

2046: Debt Hits $100 Trillion

Based on the CBO report, debt held by the public will pass the $100 trillion mark in 2046.

In nominal terms, that’s more than four times the size of the current debt and roughly as large as the entire world economy in 2022.

2053: Each Household’s Share of Debt Reaches $1 Million

The Congressional Budget Office projects that the national debt will soar to $155 trillion in 2053, putting the debt per household at a staggering $1 million.

If America falls this far, it would cease to be a nation. Federal outlays—to say nothing of state and local government spending—would exceed 30% of the economy in 2053, according to CBO.

Our children and grandchildren would carry the unbearable burden of the debts we are laying at their feet. With $6 trillion of annual interest payments on the debt, they would fall further and further behind as the national debt grows by $9 trillion per year and accelerates.

CBO’s budget outlook unmistakably shows we’re on an unsustainable path. Investors—whether domestic or foreign—can’t be expected to buy up Treasury securities to the tune of $1 million per U.S. household.

No rational investors—let alone enough to cover $155 trillion of debt—would consider Treasury securities to be a sound investment unless they had sky-high interest rates to compensate them for the risk.

Why Another ‘Clean’ Increase in Debt Ceiling Would Be Reckless

The United States is running up against its current statutory debt limit. For the Treasury to go on accumulating debt beyond this summer, Congress would have to approve a higher debt ceiling.

Before agreeing to an increase in the debt ceiling, the GOP-led House of Representatives wants to secure some spending cuts or budget reforms to begin the process of getting the nation’s finances back on track.

The White House has said it will accept only a “clean” debt ceiling increase with no spending cuts attached. Biden claims that conditioning the debt ceiling increase on spending reforms is reckless, saying, “I’m not going to get into the reckless threats that take the economy hostage in order to force an agenda that’s going to only limit American workers and weaken us internationally.”

That thinking couldn’t be more backward.

Since Biden took office in January 2021, lawmakers have brought us closer to the edge, setting us on course to smash previous expectations for the budget deficit by an incredible $6 trillion over 10 years.

Talk about reckless.

The only thing that will stop us from going over the cliff eventually is if lawmakers get serious about cutting spending before it’s too late. The only responsible action is to reverse course.

MORE: Pete Buttigieg Is Destroying Himself

MORE: Are We Watching the End of Donald Trump?

MORE: Liz Cheney: Could She Join the Democratic Party?

MORE: Liz Cheney: The Next President of the United States?

Preston Brashers is a senior policy analyst focusing on tax policy at The Heritage Foundation. This first appeared in the Daily Signal.