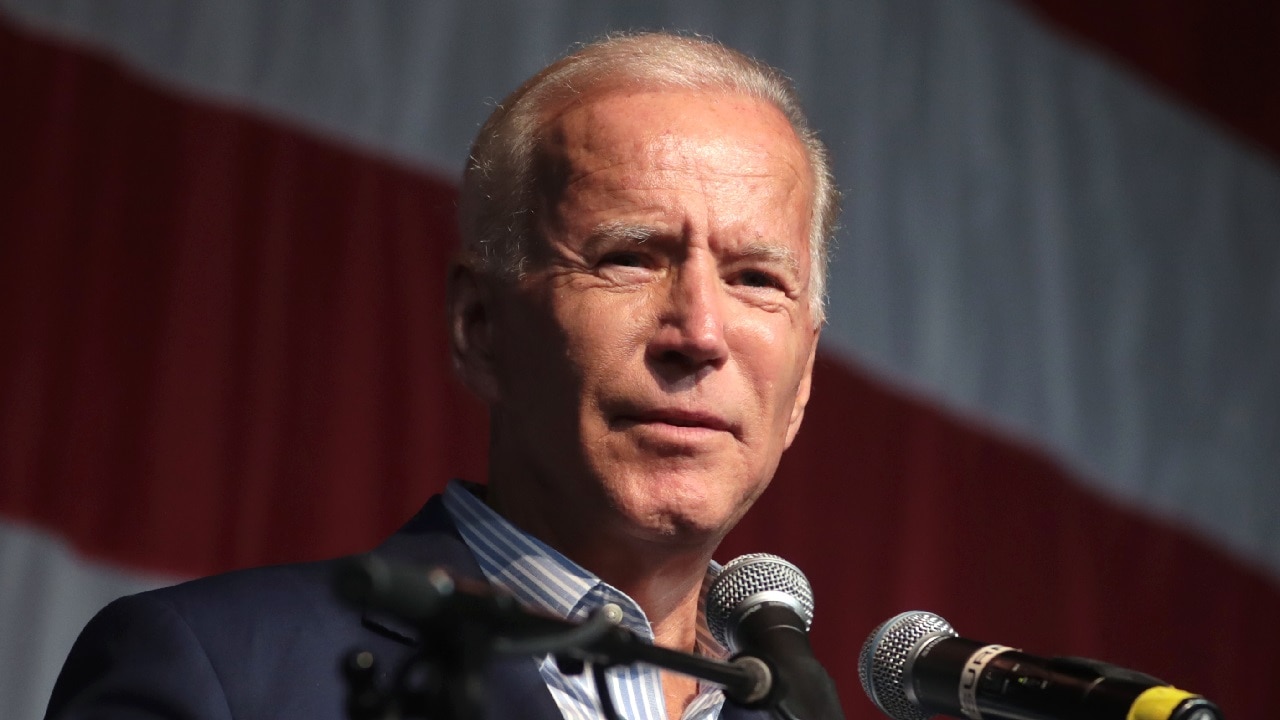

President Joe Biden wants to have a fight over taxes as we approach the 2024 Presidential Election. The release of the Biden Administration’s new budget proposal is interesting. Joe Biden apparently believes that the American people have thoroughly shifted to the Left on key economic questions and that he can put forward overt calls to hike the taxes of most Americans up as he heads into a reelection year. The forty-sixth president has furthered his argument by claiming that the proposed budget will “reduce the deficit by a whopping $3 trillion”!

To be clear: Biden’s budget is a joke. It won’t get through Congress. This is not about passing a budget, though.

Joe Biden Has a Tax Plan: It’s About 2024

Biden’s budget is an opening gambit by the Left to set the tone for what will likely be the most stringent fight over class warfare in the history of this country. The Biden Administration is making the calculation that most Americans prefer a government that does more for them—spends more of their money ostensibly on them—than a government that is more conservative in its economic policies. Biden’s class warfare rhetoric enters the equation by stating that, in order to pay for these new programs, he will need to raise taxes.

But don’t worry, says Joe Biden, it’s only the super-rich who will be paying for these programs.

So, to those who’ve been telling me that Joe Biden was a centrist, I ask them to look no further than the proposed Biden federal budget to see just how off-base that claim is. There can be little doubt that the United States has, unfortunately, become a class society. We’ve lost that which made us special: we did not have socioeconomic classes defining our nation. Instead, supposedly, anyone could move up (or down) the social mobility ladder.

Social Mobility a One-Way Street: Down

Today these claims are less true than they were even 15 years ago. Sure, some people can make it big (and others can suddenly fall hard) financially. Yet, the classes (other than the wealthy) are increasingly becoming locked into a downward spiral with little chance of upward mobility.

Whereas Biden’s open calls for increasing taxes on the top wage-earners wouldn’t have fared so well with the electorate 15-30 years ago, today most Americans have been so laid low by high interest rates, static pay, debt, and an assortment of other factors, that they need help.

Plus, the way that the media has framed things in this country, there is clearly a class war afoot.

The president desires to increase the taxes on households that make over $400,000 and impose a minimum 25 percent tax on households making $100 million.

President Biden wants to raise the corporate tax rate from 21 percent to 28 percent (and you can bet that will not be the only increase he will propose, should he get another four years). For those involved in the stock market, Biden wants to raise the excise tax on stock buybacks from one to four percent. Biden has proposed an increase to the capital gains tax as well, which will reduce the amount of money investors can keep from the sale of their stocks, bonds, etc.

Most Americans reading this are shrugging, “so what?”

Consider this: the average worker in the United States makes a measly $47,747 per year. Few Americans have any savings whatsoever to speak of. Most Americans are saddled with an insane debt load—and if you’re a Millennial or younger, your debts from college are smothering you. The idea that Biden’s rhetoric would turn off most Americans is laughable.

It might be that a more popular or dynamic figure on the Right arrives on the scene to make the counterargument in a way that appeals to more Americans and makes them less likely to approve of Biden’s policies.

But, on the face of the claims, Republicans should be concerned that they are going to be on the wrong side of this issue. Clearly, the Democrats are banking on the fact that the electorate has shifted enough to the Left that they can call for these plans without much backlash. It wouldn’t be the first time that the DNC has overestimated the public’s will to go along with their most radical plans. Although, the fact that Biden was able to become president in 2020, when he had been described as being on the radical Left-wing of the Democratic Party in 2001 by The Guardian should indicate how the electorate has changed.

And it’s changed for real reasons—namely that the American Dream is increasingly out of reach to most people and they feel as though they can’t get ahead. So, maybe getting the wealthy to pay for more benefits; to help to also pay for our burdensome debt load, just might ameliorate the suffering of most Americans.

I would personally prefer this country to embrace the Flat Tax, where there is but one, 15 percent tax imposed on all people fairly, that idea has no traction and there isn’t enough time to try to convince the electorate that that’s the best way to go forward.

Can’t Do Reagan 2.0

The Republicans should not try to make the Reagan 2.0 argument.

If there is one great gift that Donald Trump gave the Republican Party, it was that we can finally move away from some of the economic orthodoxy that has dominated the GOP far longer than it should. Reagan was a man for his time and he saved this country.

But, the problems facing the United States today are far different than they were in 1980. Thus, the solutions will need to be different. In many respects, the economic woes of America today have their roots in the economic solutions of the 1980s.

We will have to raise taxes. The question should be: on who?

The Democrats clearly want to punish corporations (job producers) and households making $400,000 or more. But, why not first target those making $5 million or more by raising the marginal tax rate on those households? The Republicans should agree that we must raise taxes—but not on anyone making less than $5 million. And there should be greater increases on taxes of billionaires or the near-billionaires. The American middle class made America great.

Biden’s Middle-Class Taxes

It is the middle class that shoulders the biggest tax burden. According to the nonpartisan Joint Committee on Taxation, Biden’s tax plan actually hits wage earners making as little as $40,000 per year and as much as $400,000. So, Biden’s budget is an assault on the American middle class and a relief to the real wealth in this country: the leisure class.

The middle-class way of life must be preserved above all others. Biden’s plan is not a recipe for fixing America’s economic woes. It is not a remedy at all. Joe Biden will only worsen America’s economic malaise. By raising taxes on businesses and those making $400,000, he will be hurting the economy.

But, if the Republicans called for targeted tax increases on members of the leisure class, they could also prevent the Democrats from pigeonholing the already damaged Republican brand and fighting the class war more effectively.

Fact is, Republican economic policies are still the best way to grow an economy. Yet, the American people still want the protection of government—and they are unlikely to ever change their mind. That is why Biden is counting on having the fight over taxes: he believes he can win that fight and make it a big election-year issue.

If Republicans agreed to raise taxes—but only on certain, very high-earning groups—they could mitigate this threat and be in a better position to win the 2024 election.

Brandon J. Weichert is a former Congressional staffer and geopolitical analyst who serves as a Senior Editor for 19FortyFive.com. Weichert is a contributor at The Washington Times, as well as a contributing editor at American Greatness and the Asia Times. He is the author of Winning Space: How America Remains a Superpower(Republic Book Publishers), The Shadow War: Iran’s Quest for Supremacy (March 28), and Biohacked: China’s Race to Control Life (May 16). Weichert can be followed via Twitter @WeTheBrandon.