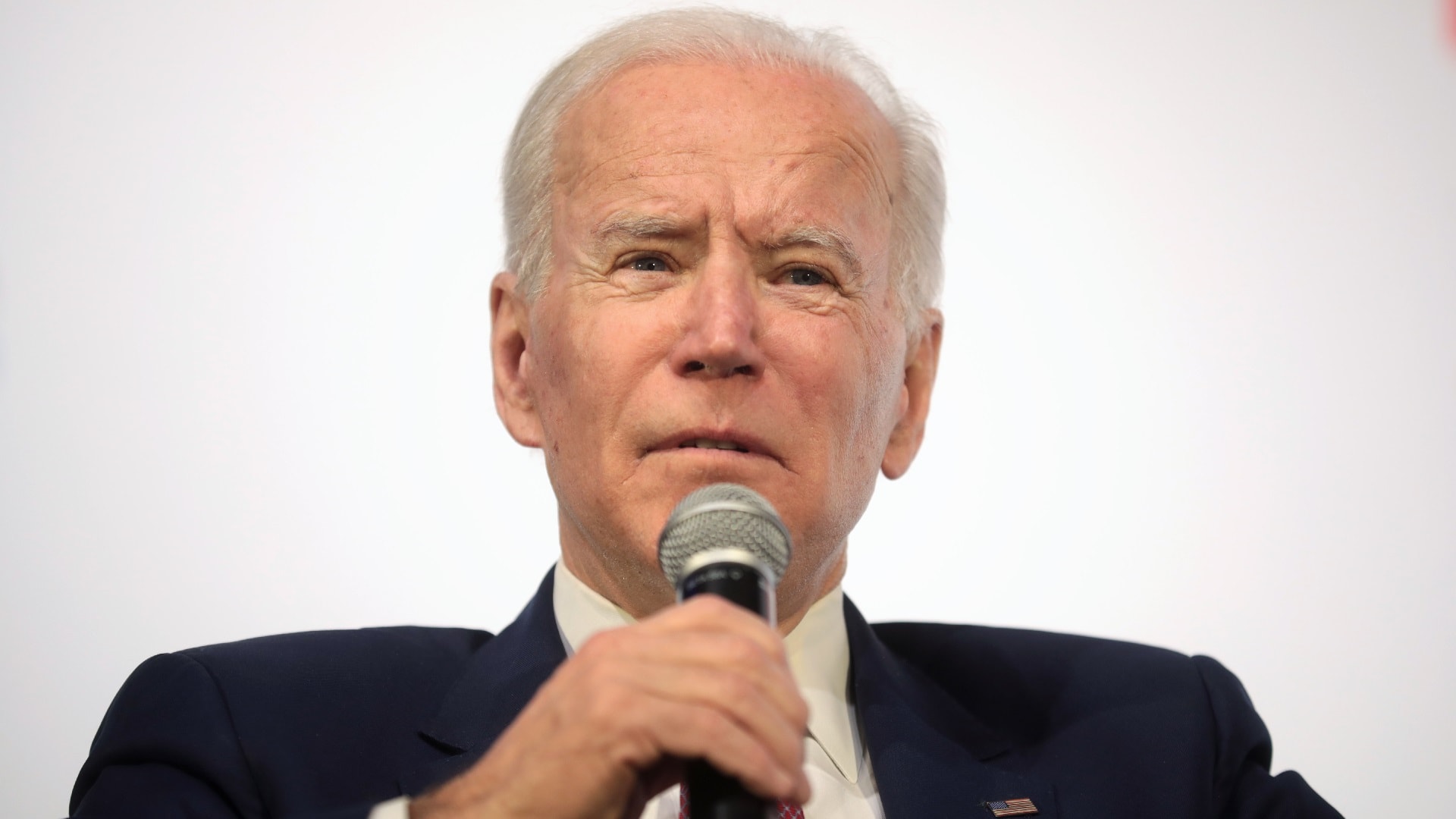

Biden’s “Blue Collar” Budget Tax Hikes Explained – President Joe Biden unveiled a budget on Thursday that appears to recycle old tax hikes that he couldn’t get passed when the Democrats controlled both the House and the Senate.

The budget, which Biden says would make the economy fairer, sees the president request $6.8 trillion from Congress – meaning it’s already dead on arrival now that the Republicans control the House of Representatives.

Knowing that the Republicans are unlikely to back any plan that involves tax hikes, the president announced his new budget at a high-profile event in Pennsylvania.

Joe Biden and the New Budget: What the Plan Entails

The Department of the Treasury released the General Explanations of the Administration’s FY2024 Revenue Proposals this week, a document that explains the proposals put forward in Biden’s budget.

Treasury Secretary Janet Yellen praised the president’s proposal, claiming that it “builds on our economic progress” – a claim that many Americans no doubt have questions about – and promising that it will ensure corporations and wealthy Americans “pay their fair share.”

“The Administration’s revenue proposals would ensure that the wealthy and large corporations pay their fair share and, in doing so, fully pay for the investments proposed in the President’s Budget while generating nearly $3 trillion in additional deficit reduction over the next decade,” the report from the Treasury Department reads.

The White House makes several proposals in three major areas, under the plan.

President Biden intends to make “smart, common-sense reforms to the tax code” which include eliminating fossil fuel tax preferences, closing the carried interest loophole, and closing estate and gift tax loopholes.

The changes would make it virtually impossible for people to avoid paying high taxes when inheriting property or receiving gifts. The rules would also impose strict new rules of investment fund managers.

Joe Biden also intends to “provide relief to workers and families” by expanding the Earned Income Tax Credit to include more people, expanding the Low-Income Housing Tax Credit to increase the supply of low-income housing, expanding the Child Tax Credit and making it pay out monthly, and also expanding tax credits for health insurance premiums.

The proposal will also see corporations and wealthy people pay significantly more in tax, effectively making the United States a less attractive place for big businesses and investors. The plan will implement a “global minimum tax” on corporations, a Billionaire Minimum Tax of 25%, and raise the tax rate for corporate stock buybacks. Biden also intends to expand the Net Investment Income Tax on income over $400,000.

Why Joe Biden Announced In Pennsylvania

The president unveiled his budget at a speech in Northeastern Pennsylvania, at the Finishing Trades Institute.

The president’s announcement is largely symbolic, given that the Republicans are not likely to vote for the plan.

However, Biden’s presence in Pennsylvania was likely orchestrated to show residents of this key swing state that Biden is working to make life better for working Americans.

Joe Biden may simply be trying to win Pennsylvania over with platitudes, knowing the budget won’t pass, and likely knowing that making the U.S. less attractive for businesses also means less investment in communities across America.

MORE: Joe Biden: Too Old To Be President?

MORE: Kamala Harris Could Be Replaced?

MORE: Donald Trump Headed to Jail?

MORE: Joe Biden Keeps Breaking the Law

Jack Buckby is 19FortyFive’s Breaking News Editor. He is a British author, counter-extremism researcher, and journalist based in New York. Reporting on the U.K., Europe, and the U.S., he works to analyze and understand left-wing and right-wing radicalization, and reports on Western governments’ approaches to the pressing issues of today. His books and research papers explore these themes and propose pragmatic solutions to our increasingly polarized society.