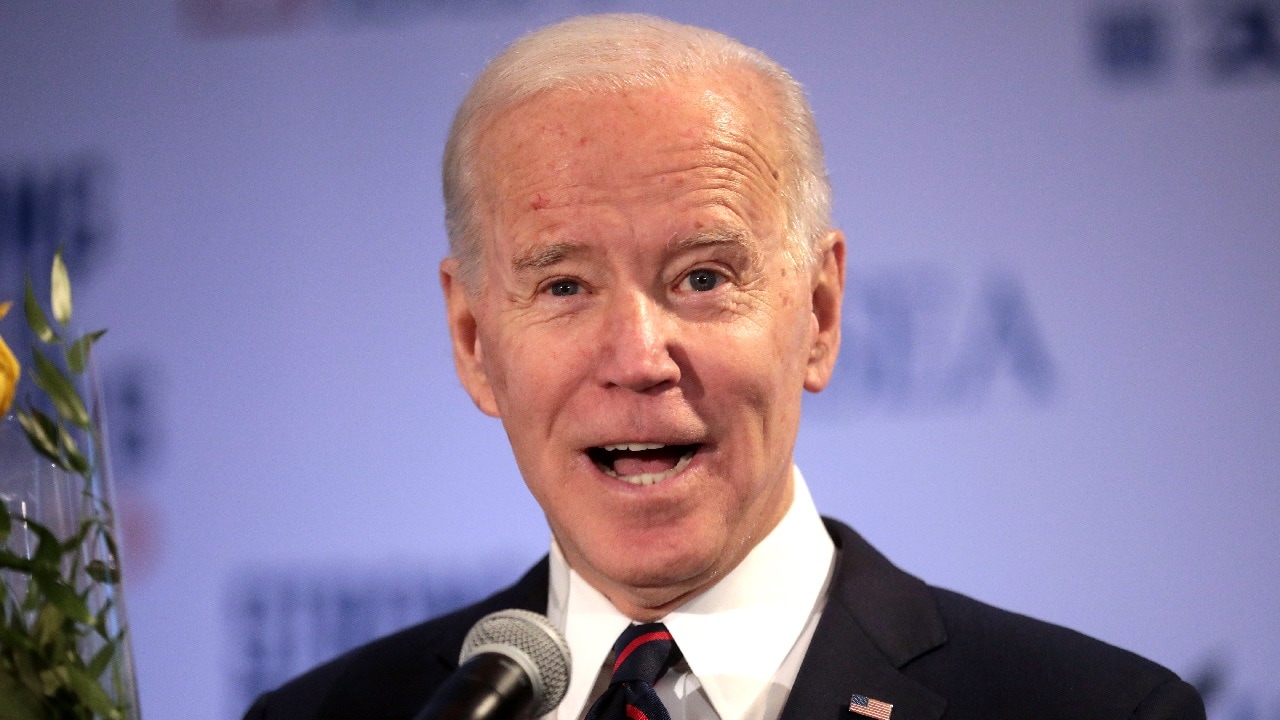

I’m writing again about President Biden’s new mortgage rule, which adjusts fees based on a borrower’s credit score because I don’t think the rule is receiving sufficient media attention for being the moral and functional blunder that the rule is.

In case you missed it, earlier this month, a new Biden Administration Federal Housing Finance Agency (FHFA) rule went into effect that will require borrowers with better credit scores, and borrowers who make larger down payments to pay higher mortgage rates.

You read that correctly.

Borrowers with better credit scores, and borrowers who make larger down payments, will need to pay higher mortgage fees than borrowers with low credit scores, and borrowers who make lower down payments.

I can’t quite get over it. The thing is so patently absurd.

Yet, there are other things happening, like Ukraine and the debt ceiling and the GOP primaries, and Biden’s discrete mortgage rule has already faded into media obscurity, despite the backlash the rule has caused.

So, I’ll do my part – to amplify the backlash.

Because I am deeply irritated, at both the unfairness and the fundamental impracticality of the new mortgage rules.

The new rule rewards bad behavior

If my harping against Biden’s new mortgage rule sounds like sour grapes that because it is sour grapes.

I’ve spent years living frugally. Pinching pennies.

Only spending what I have.

Avoiding credit card debt.

Saving what I have in the hopes of gaining security and enhanced wealth through home ownership.

I’m a way off from buying a home. But at least my credit rating is high – a simple reward for playing according to the rules, which, until Biden interceded, provided comfort in knowing that I would receive favorable mortgage rates one day.

I’m not alone.

Millions of Americans, across the socio-economic spectrum, have playing according to the rules. And now, the lot of us are going to be subsidizing the Americans who played it loose. Who bought the Corvette they couldn’t afford. Or blew paychecks on sports betting. Or racked up credit card debt. Under Biden’s new rule, the Americans with the bad credit rating are going to be earning the more favorable mortgage rating.

The crazy part is that credit rating (and down payments) alone determines the mortgage rate, meaning that a guy making seven figures a year, who happens to have bad credit, will get a better credit rating than the guy making 50k a year, who lived responsibly.

It’s sick stuff, rationalized as a means to encourage home buying, or close the racial home ownership-gap.

But that’s nonsense.

The new rule is as likely to discourage home buying (amongst those with good credit) as encourage home buying (amongst those with bad credit). And of course, the rule operates based on credit rating, not race or ethnicity.

The real motive for the rule (in my best guess) is that it allows lenders to lend to whomever they want. The new rule opens the doors for lenders to make deals with people who, otherwise, would not be able to secure a loan for buying a home because that person was deemed too risky.

But now, with the good credit borrower subsidizing the bad credit borrower, the bad credit borrower is suddenly less risky. And did we learn nothing from 2008? From the perils of allowing people to live beyond their means?

Biden’s new rule is a moral and functional blunder.

MORE: Hunter Biden Could Finally Be Charged with a Crime

MORE: Hunter Biden: Could Be Go to Jail?

Harrison Kass is the Senior Editor at 19FortyFive. An attorney, pilot, guitarist, and minor pro hockey player, Harrison joined the US Air Force as a Pilot Trainee but was medically discharged. Harrison holds a BA from Lake Forest College, a JD from the University of Oregon, and an MA from New York University. Harrison listens to Dokken.