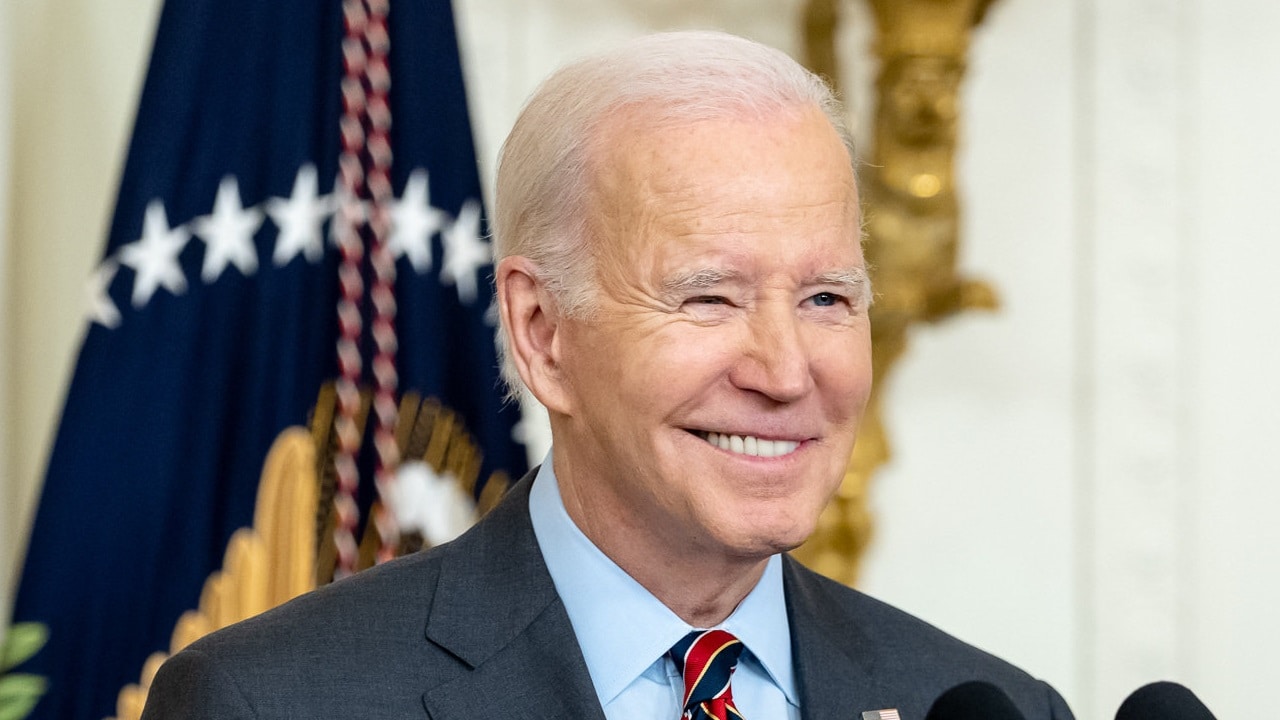

Biden Is Making a Big Mortage Mistake: I wrote earlier in the week to condemn President Biden’s new pricing structure for federally guaranteed mortgages. I’m glad to see I’m not the only one upset with the rule changes (which essentially force higher credit homebuyers to subsidize lower credit homebuyers); the new rule has sparked a backlash of criticism – as it should.

What Is Biden Doing Wrong?

Apparently, “financial officers in 27 states recently wrote an open letter to the White House asking President Biden to rescind the new rule,” The Hill reported, “saying the fees will make it significantly more expensive for borrowers with good credit to purchase a home.”

According to the open letter, Biden’s new policy, which “will force homebuyers with good credit to pay more on their mortgage every single month,” will in effect, “take money away from the people who played by the rules and did things right – including millions of hardworking, middle-class Americans who built a good credit score and saved enough to make a strong down payment.”

Oh, that’s another thing: homebuyers who make a down payment of 20 percent or more will also be subject to higher monthly mortgage fees. Yes, I’m serious. If you make a down payment of 20 percent or more you will be subject to higher mortgage fees; if you have good credit (680 or above) you will be subject to higher mortgage fees. The rule went into effect on May 1st and I’m still having trouble processing.

“For decades,” the open letter continued, “Americans have been told that they will be rewarded for saving their money and building a good credit score.” But Biden’s new policy “turns that time-tested principle upside down.”

Joe Biden Is Making A Major Mistake?

Sincerely, what have we been saving for exactly?

What have we been building good credit for?

We were told that the bigger the down payment we made the lower the mortgage fee. We were told the better our credit the lower our mortgage fee. Many of us – many of us with humble financial backgrounds – have been doing exactly that in the hopes of securing our financial futures through home ownership. We took the bus, bought food in bulk, skipped vacations, went to community college, flipped stuff on eBay for a $14 profit – and only bought what we could afford—all with the understanding that our frugality and our responsibility would be rewarded.

Meanwhile, the guy buying cars he couldn’t afford on credit, and taking dates out to restaurants he couldn’t afford on credit, and spending the money he should have been saving on items he shouldn’t and cruises and Amazon impulse purchases, who wrecked his credit and his savings in the process – that’s the guy who’s getting rewarded.

Straight up. Paula Abdul. No hyperbole.

He is going to have a more favorable mortgage rate, explicitly because he has a worse credit rating and/or made a lower down payment.

And never mind the fact that the guy with the crummy credit, getting the primo mortgage rate, may well be upper-class. That’s right – because Biden’s new rules aren’t adjusted towards income brackets; rather, the new rules are simply about credit rating and down payment. So, the guy making a million bucks a year with a 630-credit rating will get a better mortgage rate than the guy making $50k a year with a 730-rating.

And aside from the stark unfairness of it all, bear in mind that it’s really a policy geared towards allowing lenders to make loans more easily to high-risk borrowers – which is exactly the type of behavior that led to the 2008 crash.

In sum: Biden’s new mortgage rule is wrong on many, many levels. Biden needs to really think about this.

MORE: Could Donald Trump Be Disqualified from Becoming President Again?

MORE: Could Donald Trump Quit the GOP?

Harrison Kass is the Senior Editor at 19FortyFive. An attorney, pilot, guitarist, and minor pro hockey player, Harrison joined the US Air Force as a Pilot Trainee but was medically discharged. Harrison holds a BA from Lake Forest College, a JD from the University of Oregon, and an MA from New York University. Harrison listens to Dokken.