Joe Biden’s plan to save Social Security from insolvency would hike the amount of covered taxable income in a bid to forestall the program’s projected depletion in 2033. Under the president’s plan, the 12.4% payroll tax that is split between the taxpayer and the employer would be extended to income over $400,000 annually.

“The President is focused on the immediate threat to Social Security: Congressional Republican attempts to cut benefits,” White House spokesperson Robyn Patterson told Newsweek. “He welcomes proposals from members of Congress on how to extend Social Security’s solvency without cutting benefits or increasing taxes on anyone making less than $400,000.”

The current maximum taxable earnings limit stands at $162,000. According to the Social Security Administration, only 6% of taxpayers earn more than that limit. The percentage of earnings subject to the Social Security tax continues to shrink.

A University of Maryland poll found that 81% agreed with Biden’s proposal. That included 79% of Republicans and 88% of Democrats.

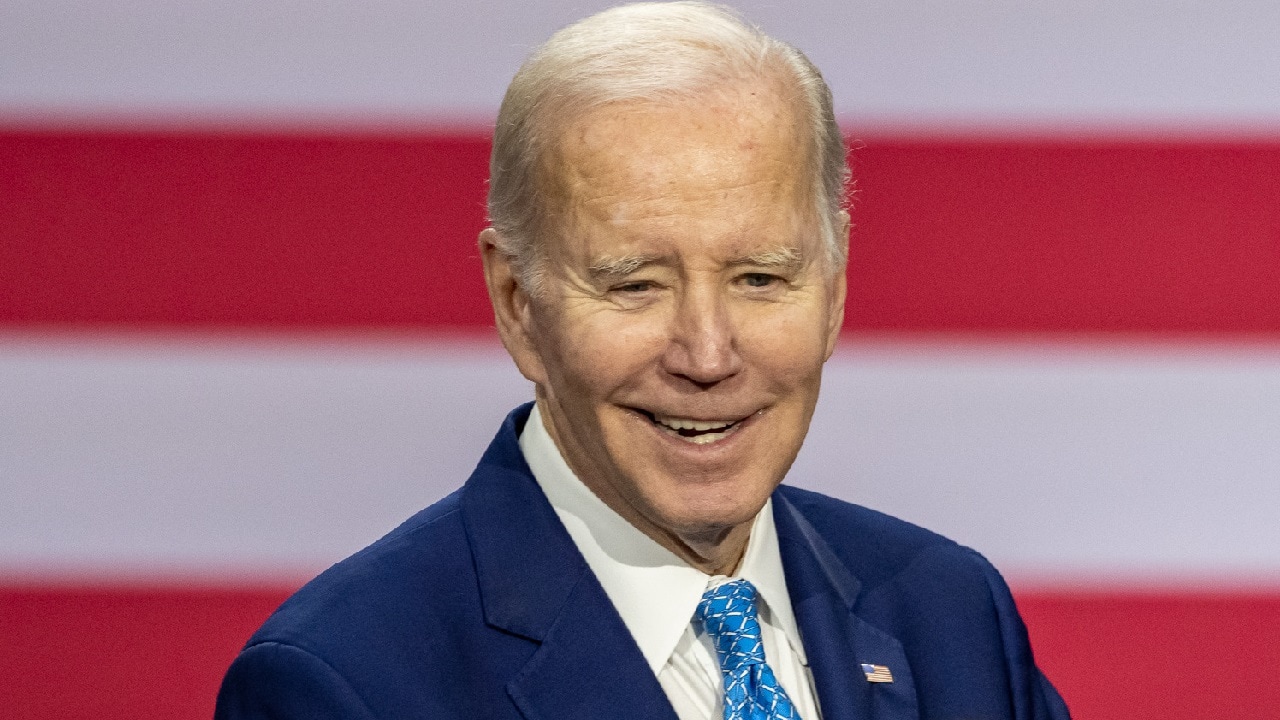

Joe Biden: Raise Taxes to Save Social Security

“Any income above the limit is not taxed for the purposes of the Social Security program. In other words, someone making $170,000 per year pays the same amount in taxes as someone making $1.7 million per year,” the Motley Fool writes. “[Enacting the president’s plan] would effectively create a donut hole between the current taxable limit ($160,200) and $400,000, but the gap would get smaller and eventually close as the taxable limit rises each year. Eventually, all income would be subject to Social Security payroll tax.”

Forty years ago, Joe Biden supported Social Security benefit reductions. He voted for the Social Security amendments in 1983 that raised the full retirement age to 67 over the course of decades. The 1983 reform was the last time any substantial changes were made to the program. The problem with the 1983 reform is that the high-earner threshold never has been updated to keep up with inflation over the succeeding 40 years.

The 1983 reform allowed up to 50% to be taxed for single individuals making more than $25,000 for individuals or $32,000 for couples filing jointly. That would be roughly equal to $76,000 for individuals or $97,000 for couples filing jointly in 2023 dollars.

The Omnibus Budget Reconciliation Act of 1993 added a second income threshold. It made 85% of benefits taxable for those making $34,000 for individuals and married couples making more than $44,000 filing jointly.

Social Security Benefit Cuts Likely Unavoidable

“I have no doubt that Biden would like to avoid Social Security cuts. But resolving the $22.4 trillion funding shortfall without reducing benefits in some way seems unrealistic, especially when past reforms have included benefit reductions. Social Security outlays consumed 4.8% of U.S. gross domestic product (GDP) in 2022, up from the 50-year average of 4.4%, and that figure is expected to reach 6% of GDP by 2033. That trend is simply unsustainable,” Motley Fool columnist Trevor Jennewine wrote.

“For that reason, lawmakers will likely need to reduce benefits to keep the trust fund solvent beyond 2034, just as Congress cut benefits in 1983 and 1993. But retired workers shouldn’t fret just yet. Those benefit cuts could take many forms, meaning different cohorts could be disproportionately affected.”

John Rossomando is a senior analyst for Defense Policy and served as Senior Analyst for Counterterrorism at The Investigative Project on Terrorism for eight years. His work has been featured in numerous publications such as The American Thinker, The National Interest, National Review Online, Daily Wire, Red Alert Politics, CNSNews.com, The Daily Caller, Human Events, Newsmax, The American Spectator, TownHall.com, and Crisis Magazine. He also served as senior managing editor of The Bulletin, a 100,000-circulation daily newspaper in Philadelphia, and received the Pennsylvania Associated Press Managing Editors first-place award for his reporting.

From 19FortyFive

AOC Just Proved How Stupid She Is