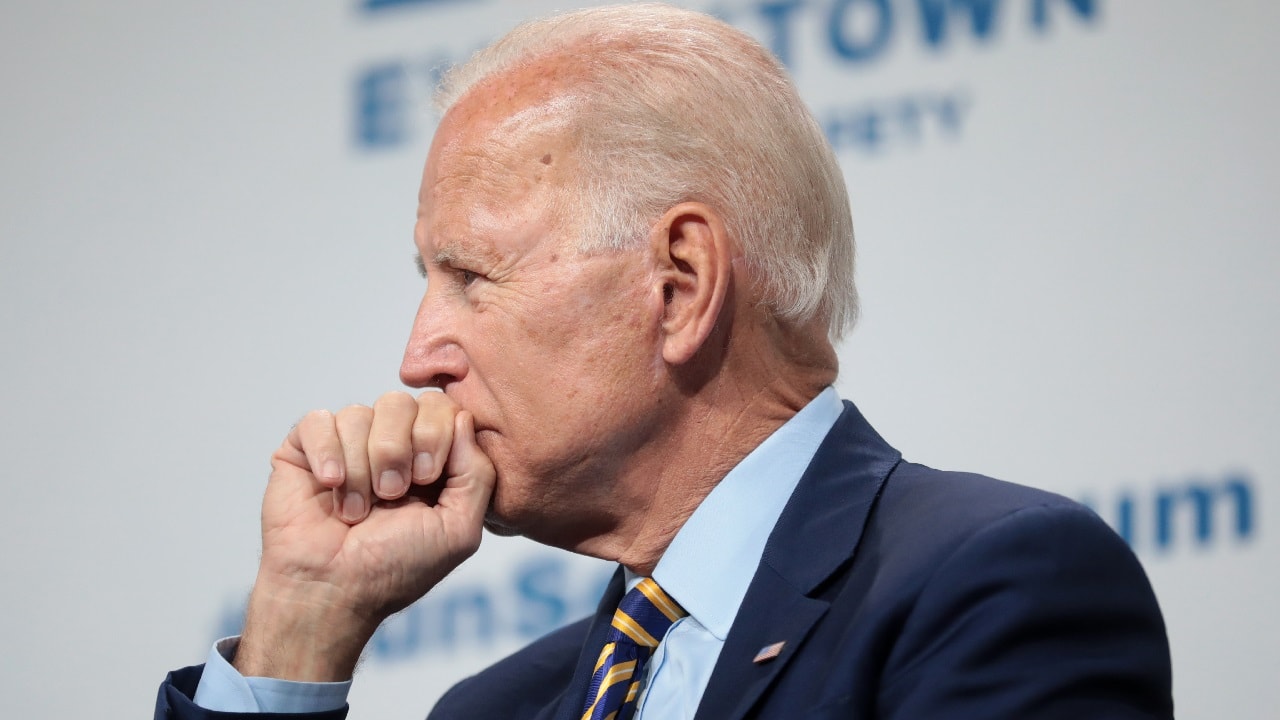

We knew this was coming, but now that it’s here, it still stings. The Supreme Court shot down Biden’s student loan forgiveness plan, arguing that President Biden had exceeded his constitutional authority in granting loan forgiveness.

Biden’s plan, to forgive $10,000 for all borrowers, and up to $20,000 for Pell Grant recipients, wasn’t especially generous but it was something. Now that something has been wiped out entirely. Biden, addressing reporters, after the SCOTUS ruling was made, said the court had “misinterpreted the Constitution” and said that his administration would find an alternative way to grant student debt relief.

But don’t get your hopes up.

Winter is coming

In two months, student loan repayments will resume for the first time since March 2020.

It’s going to be a gut punch for borrowers who have spent the last forty something months without a loan payment.

To ease the transition into repayments, Education Secretary Miguel Cardona is rolling out a series of measures.

The first is a 12-month “on-ramp” where borrowers who miss payments won’t have their credit score tarnished, although interest will continue to accrue.

The second is that borrowers will be eligible for “income-driven” payment plans allowing for payments as low as 5 percent of their monthly disposable income.

A few thoughts on student loans

Higher education is a rigged game.

For many Americans, getting a degree is the surest path to the middle-class.

And for students interested in specific fields that happen to require a degree or two (law, medicine, architecture, whatever) then college is the only game in town.

But with the cost of education going up and up, unfathomably higher, students without affluent parents need to take out loans to afford tuition.

Then, of course, those students are saddled with student debt upon graduating. And as the return on investment of a college education diminishes, students are less and less likely to earn employment upon graduating that allows for repaying the loans in an efficient manner.

The result is lingering debt.

So, kids without rich parents are in a weird Catch-22. Skip college and accept a fate of lower earning potential. Or attend college and accept their fate of lingering debt.

Rich kids meanwhile, go to college, have their parents pay, take a job after graduating that their cost-free education has enabled, and cash their entire paycheck without worrying about loan repayments.

The end result is that college, which was meant to level the playing field and allow anyone to join the middle class, has become something that costs more for poor kids than it does for rich kids. That’s sick stuff. And to ensure that the socio-economic status quo is preserved is student loans. Debt-accruing student loans. Higher education is a rigged game, and student loans are a part of the fix.

And I’ll tell you what: the idea that students in debt are going to repay their student loans is a fantasy.

Many borrowers are just going to let their debt sit untouched, accruing interest. Those borrowers will die before they invest in paying off their student loan debt. Other borrowers are going to take public interest jobs so that after ten years, the borrower can qualify for student loan forgiveness.

In either case, the government ain’t getting no loans repaid.

So, it doesn’t make much sense for the government to wait around on those loans that ain’t getting repaid. Instead, those loans should be forgiven for practical reasons: allowing the borrowers to participate fully as consumers in the economy – rather than handicapping the consumer with bad credit, or with monthly minimums.

Harrison Kass is the Senior Editor and opinion writer at 19FortyFive. An attorney, pilot, guitarist, and minor pro hockey player, Harrison joined the US Air Force as a Pilot Trainee but was medically discharged. Harrison holds a BA from Lake Forest College, a JD from the University of Oregon, and an MA from New York University. Harrison listens to Dokken.

From 19FortyFive

AOC Just Proved How Stupid She Is