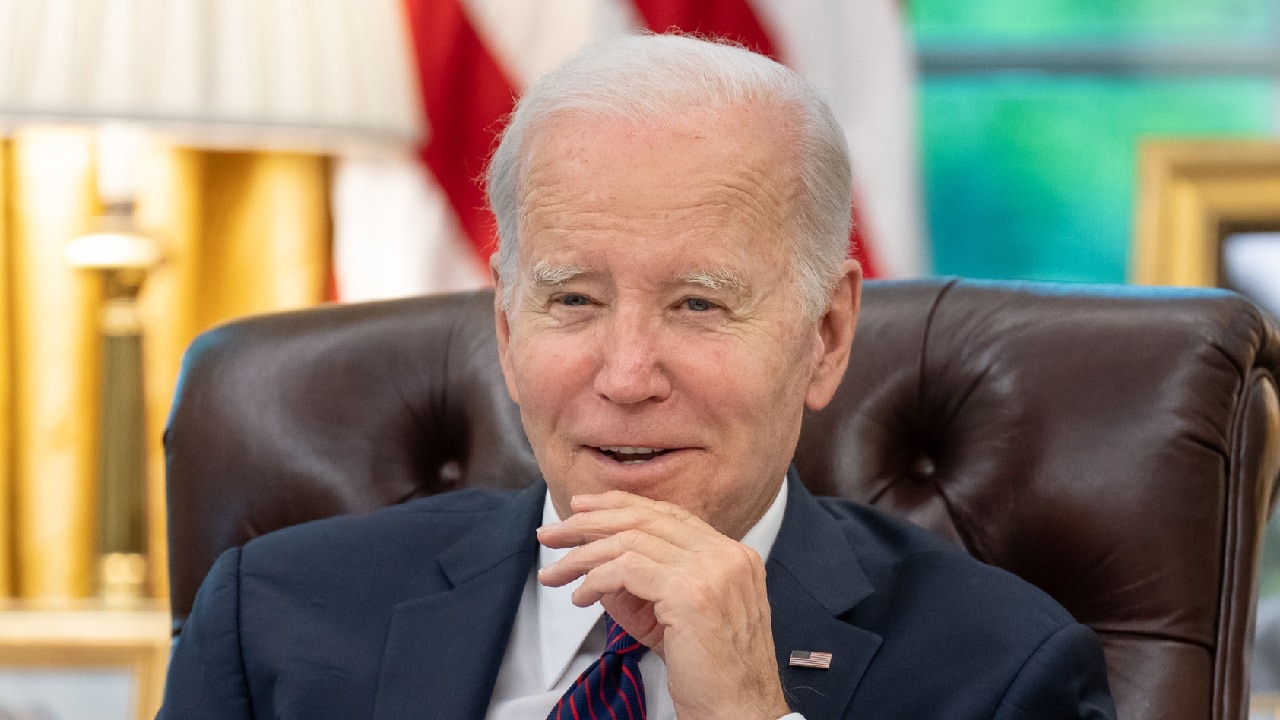

Joe Biden could be in trouble over this: The pause on federal student loans that began in March 2020 will end next month, while interest already began to accrue on the first of September. Beginning in October, more than 43 million Americans will need to start making their loan payments once again.

As has been reported, many borrowers could suddenly face “payment shock” as they’re dealing with high inflation and will be unable to budget for the new expense – which could be substantial for many. The Consumer Financial Protection Bureau warned that one-in five student loan borrowers could struggle to make payments once the pause ends.

According to data from WalletHub, residents of Pennsylvania, Mississippi, New Hampshire, Delaware, and New Jersey are among those who will be affected by the end of the moratorium on student loan repayment – while those in Idaho, New Mexico, Montana, Washington, and Wyoming are least impacted.

The issue of student loans is likely to be a hot-button issue in the 2024 election, as 48 percent of those surveyed by WalletHub said they believed the loan moratorium was not fair to American taxpayers, while more than three in four people with student loan debt said the moratorium was helpful for them personally, and 56 percent said the debt and the end of the student loan moratorium will affect their finances a great deal.

Biden Handouts

After the Supreme Court struck down the Biden Administration’s plan to cancel $430 billion in student loan debt in June, the White House rolled out smaller debt relief programs.

This included the Saving on a Valuable Education (SAVE) plan that was designed to cut borrowers’ monthly payments and keep balances for borrowers from growing due to unpaid interest. The plan, which more than four million have already enrolled in, would also allow those with education debt to repay the loans based on income, rather than on a fixed monthly amount. It also increased the floor required for payments – from 150 percent of the poverty line to 225 percent.

As a result, many more borrowers could end up with bills totaling $0 per month. The SAVE plan would also reduce the amount of income considered by the government when calculating payments for all borrowers in the plan, lowering bills for nearly every borrower enrolled.

However, last week House Republicans called the new repayment plan to be little more than a backdoor loan forgiveness program, sought to advance legislation to overturn SAVE, and the House education committee voted 23-19, along party lines, to approve a resolution (H.J. Res. 88), which blocks it.

The Biden administration has estimated SAVE to cost $156 billion over the decade, while the Congressional Budget Office had previously pegged the figure at $230 billion – and outside analysts have said it could be as high as $475 billion, Politico.com reported.

The GOP lawmakers had sought to repeal Biden’s prior student relief program, and it passed Congress with a handful of Democratic votes, only to be vetoed by the president. It was ultimately struck down by the Supreme Court. Republicans are now seeking to invalidate SAVE under the Congressional Review Act, which allows lawmakers to swiftly overturn recently enacted executive branch policies. That could allow the GOP to force a vote on the measure in the Democratic-controlled Senate.

The fight over student loans and who will ultimately pay for it is far from over.

Author Experience and Expertise

A Senior Editor for 19FortyFive, Peter Suciu is a Michigan-based writer. He has contributed to more than four dozen magazines, newspapers, and websites with over 3,200 published pieces over a twenty-year career in journalism. He regularly writes about military hardware, firearms history, cybersecurity, politics, and international affairs. Peter is also a Contributing Writer for Forbes and Clearance Jobs. You can follow him on Twitter: @PeterSuciu.