Americans Banked Their Stimulus Checks – Was It Worth It?: The United States federal government delivered American taxpayers three rounds of direct stimulus payments throughout the COVID-19 pandemic at a cost of roughly $850 billion.

Designed to help Americans pay for essentials during a time of economic uncertainty, lockdown, and mass unemployment, the checks did help Americans cover some basic costs at a long-term cost to the economy.

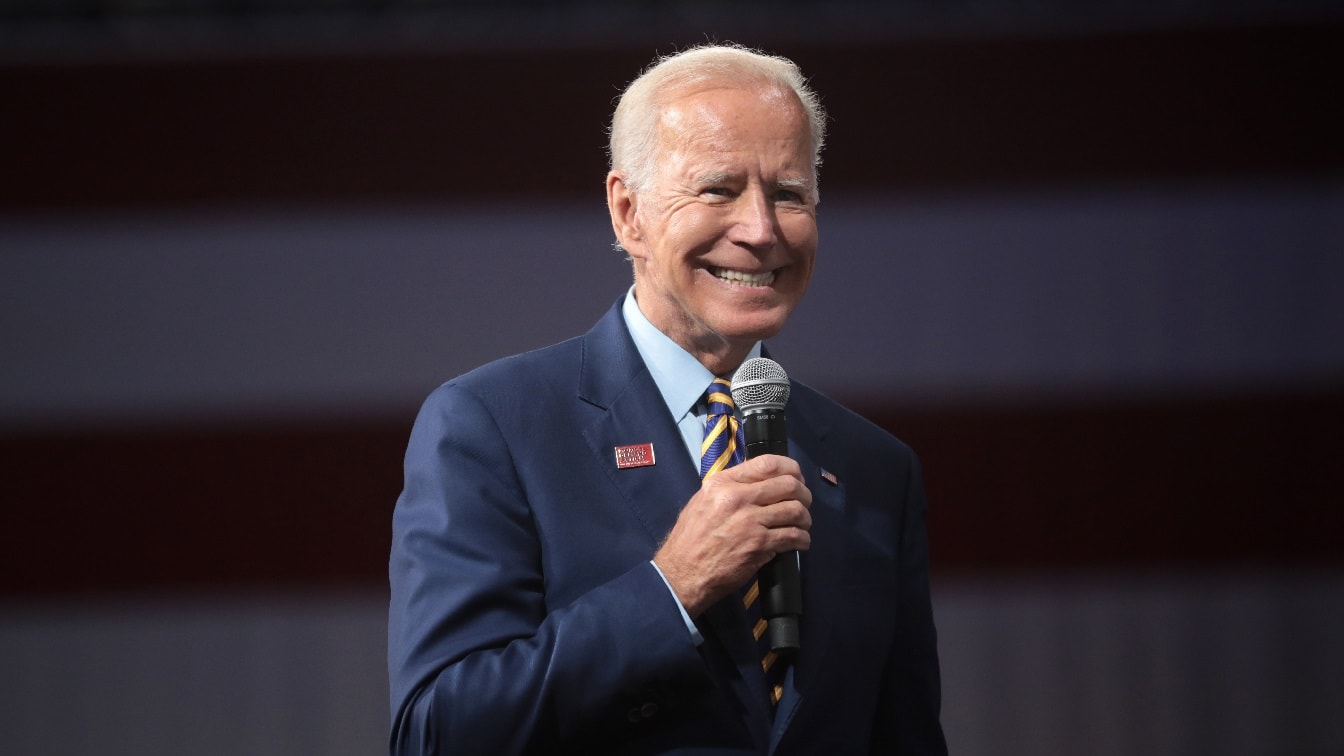

Under the CARES Act of 2020, taxpayers received $1,200 per adult and $500 per child. In the second round, facilitated by the Consolidated Appropriations Act, taxpayers received $600 per adult and $600 per child. In the third round, under President Joe Biden’s American Rescue Plan Act, adults received $1,400 each and a further $1,400 per child.

Was It Worth It?

According to estimates from the Congressional Budget Office, stimulus checks increased economic output by around 0.6% and resulted in a 2.4% increase in consumer spending at the beginning of 2021. It means the checks did have some effect on the economy in the short term – but that figure would have been different if more people had spent the checks.

Many would also argue that the short-term beneficial effect of the checks is heavily outweighed by the economic woes facing American taxpayers now that they have returned to work – from depleted Social Security trusts to rising inflation.

Most Americans Saved Most Of Their Checks

The United States was the second-largest fiscal responder to the COVID-19 pandemic, closely following Singapore. Unlike many European countries that favored loans and furlough schemes, the United States engaged in a risky direct payment strategy that ultimately saw most Americans stashing stimulus payments away.

Bank of America CEO Brian Moynihan revealed in June how Americans have saved as much as 70% of their most recent stimulus checks. It means that hundreds of billions of dollars were set aside by taxpayers either because they didn’t need the direct payment or in anticipation of future economic woes.

“Our consumers have lots of money in their checking accounts,” he told CBS.

This was also true for the second round of stimulus checks that were issued at the end of December 2020. According to surveys from the Federal Reserve Bank of New York, Americans said that they spent or planned to spend 25.5% on average of the $600 checks they received.

A majority of the money received was banked in savings accounts or used to pay debts.

Stimulus Checks Reduced Hardship for Those Who Needed Them

Stimulus checks did help American families. According to an analysis of Census Bureau surveys, the most recent two rounds of stimulus checks helped millions of Americans pay household deals, manage debt, and buy food.

The report, which came from the University of Michigan, found that material hardship in American households fell sharply after the December 2020 COVID-19 relief bill was passed, as well as after the American Rescue Plan Act of March 2021.

Between December 2020 and April 2021, food insufficiency dropped by more than 40%, financial instability fell by 45% and reported cases of mental health problems dropped by 20%. Researchers argued that the success of these two programs in terms of helping Americans cover costs was due to the “speed, breadth, and flexibility of its broad-based approach, primarily relying on cash transfers.”

How these large fiscal packages will play out in the long-term, however, is yet to be seen. Rising inflation and a supply chain crisis may just be the beginning.

Jack Buckby is a British author, counter-extremism researcher, and journalist based in New York. Reporting on the U.K., Europe, and the U.S., he works to analyze and understand left-wing and right-wing radicalization, and report on Western governments’ approaches to the pressing issues of today. His books and research papers explore these themes and propose pragmatic solutions to our increasingly polarized society.