Bidenomics Defended? Republicans have lambasted Bidenomics due to its connection with inflation.

However, a liberal economist says critics should look at its contribution to economic growth instead.

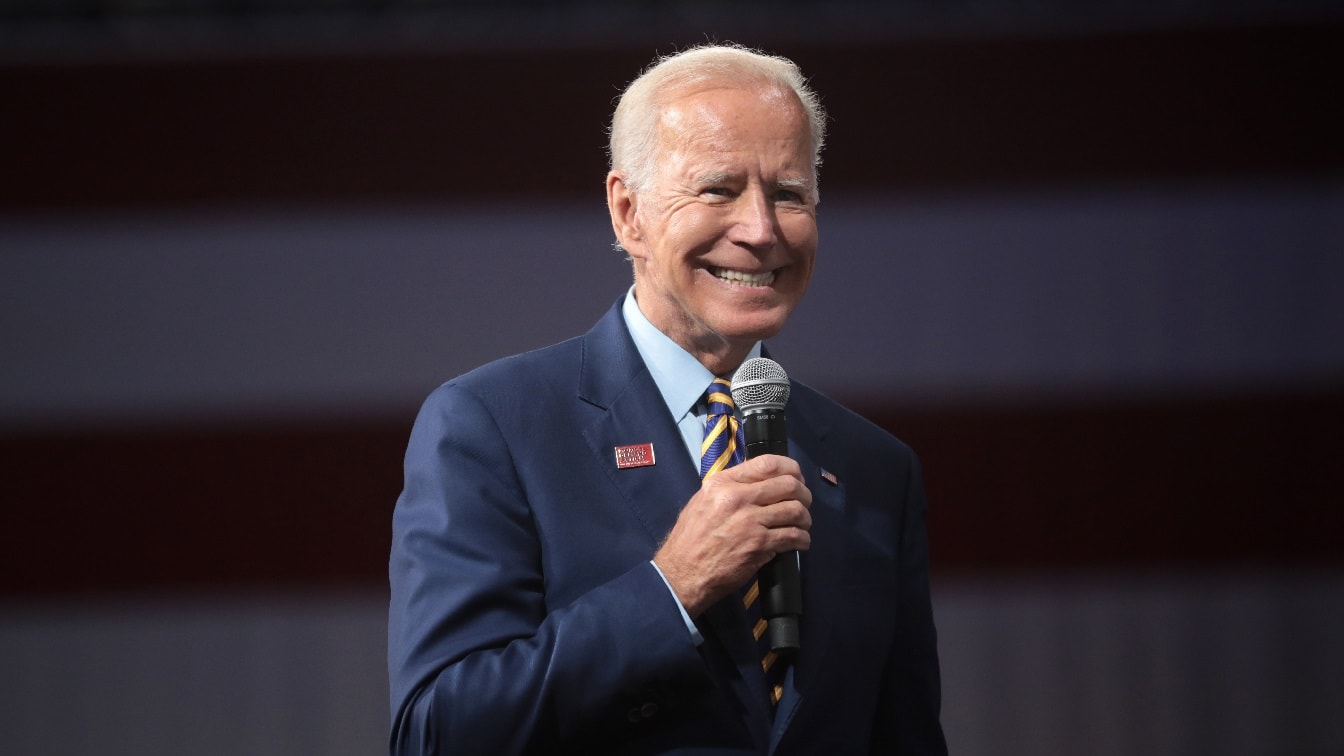

Joe Biden’s return to a Keynesian economic approach based on the idea that government spending fuels growth

Why We Should Like Bidenomics

“Most importantly, growth recovered remarkably quickly from the pandemic recession. The economy returned not only to pre-pandemic trends but to pre–Great Financial Crisis trends as well, suggesting that the prolonged pain of the post-financial-crisis recession was avoidable,” Open Markets Institute Chief Economist Brian Callaci writes in The Atlantic.

“Biden’s first big legislative accomplishment was the $1.9 trillion American Rescue Plan Act of 2021, which unleashed a fiscal fire hose onto the U.S. economy. That law was followed by more legislation that went beyond merely increasing spending. The 2022 Inflation Reduction Act steered investment specifically toward fighting climate change. The law eschews the tweezer of, say, carbon taxes, which leave decisions to the wisdom of the market, in favor of direct federal interventions.”

Callaci continued, “For example, while previous policies relied nearly exclusively on the tax code to support investments in zero-carbon energy projects, the IRA contains provisions allowing nonprofit utilities that invest in zero-carbon power generation to obtain federal grants.”

He contends that the Biden administration’s policies can build a political coalition among stakeholders including “unions, environmentalists, and rural voters, it might assemble a lasting political coalition behind its vision of green growth.”

GM Casts Cloud on Economic Green Idealism

Meanwhile, General Motors is not seeing the projected demand for the electric vehicles that underpin the Biden economy.

“We are also moderating the acceleration of EV production in North America to protect our pricing, adjust to slower near-term growth in demand, and implement engineering efficiency and other improvements that will make our vehicles less expensive to produce, and more profitable,” the letter to GM shareholders reads.

He notes that the economics pushed by Republicans since the Reagan era that called for reduced regulations and government direct interference in the economy had not yielded the sort of growth that had existed in the immediate post-World War II era. This thinking developed at the University of Chicago under the leadership of the late Milton Friedman.

“In short, the Chicago school got virtually everything it asked for. Big firms grew bigger, corporations prioritized their stock prices above all else, and private-sector unions were all but wiped out. But 40 years of tweezing out the inefficiencies allegedly holding back the economy did not revive the growth rates of the pre-stagflation era,” Callaci writes. “The U.S. economy grew an average of 4 percent a year from 1948 to 1973. During the crisis years, from 1974 to 1979, it grew more slowly, on average only 3 percent a year. Then came the tweezers, and growth didn’t budge. From 1980 to 2007, it plodded along at the same 3 percent rate of the crisis years, before falling off a cliff after 2007—all the way down to 1.6 percent from 2008 to 2020.”

He continued, “The shareholder revolution helped hollow out the American industrial base and transfer massive wealth to financial engineers. And although the labor movement was defanged, the hoped-for productivity explosion never happened.”

Not Everyone Sold On Bidenomics

Critics are not satisfied and look to the impact that Bidenomics has had on inflation, which was a significant concern for Friedman, who said that inflation always was a creation of government.

Libertarian economist Vernique De Rugy looks at Bidenomics and sees it a massive enabler of inflation.

Although inflation has fallen from the height of 9% in June 2022, the costs of core commodities, including food, energy, and housing, remain higher than before the pandemic.

“By now, it’s well-known that Bidenomics’ big spending has fueled higher inflation, resulted in larger-than-projected deficits and contributed to a record level of government debt. The most recent estimate of the full-year deficit for 2023 is $1.5 trillion, up from $946 billion last year. Total federal debt is now more than $33 trillion, an increase from $28.5 trillion in 2021. Budget tensions led the credit agency Fitch Ratings to downgrade Treasury debt based on prospects of further fiscal deterioration. This is not great, seeing as federal borrowing is projected to be $120 trillion in the next 30 years,” De Rugy wrote. “The prospect of gigantic, never-ending deficits during good times is making investors nervous. Borrowing costs like mortgage and car loan rates are rising, as are yields on benchmark 10-year treasury notes. They’re now above 4.3%, their highest level since 2007 — more especially heavy burdens on lower-income Americans.”

As long as inflation remains high, esoteric ivory tower defenses of Bidenomics will fall on deaf ears because voters will vote based on the pain in their pocketbooks.

John Rossomando is a defense and counterterrorism analyst and served as Senior Analyst for Counterterrorism at The Investigative Project on Terrorism for eight years. His work has been featured in numerous publications such as The American Thinker, The National Interest, National Review Online, Daily Wire, Red Alert Politics, CNSNews.com, The Daily Caller, Human Events, Newsmax, The American Spectator, TownHall.com, and Crisis Magazine. He also served as senior managing editor of The Bulletin, a 100,000-circulation daily newspaper in Philadelphia, and received the Pennsylvania Associated Press Managing Editors first-place award for his reporting.

From the Vault