There is never a good time for a protracted fight over raising the US government debt ceiling. However, today would seem to be a particularly bad time for such a fight. Not only do the US and world economies appear to be on the cusp of recession. US and world financial markets appear to be especially vulnerable to a major loss of risk appetite that fears about a possible default by the world’s largest government debtor would almost certainly involve.

There can be little doubt that we now appear to be heading towards a major debt ceiling fight by early this summer. In a letter to House Speaker McCarthy, Secretary Treasury Janet Yellen indicated that the US government has now reached its debt ceiling limit. She also indicated that the Treasury will be taking “extraordinary measures” that should allow the government to avoid a debt default at least until early June.

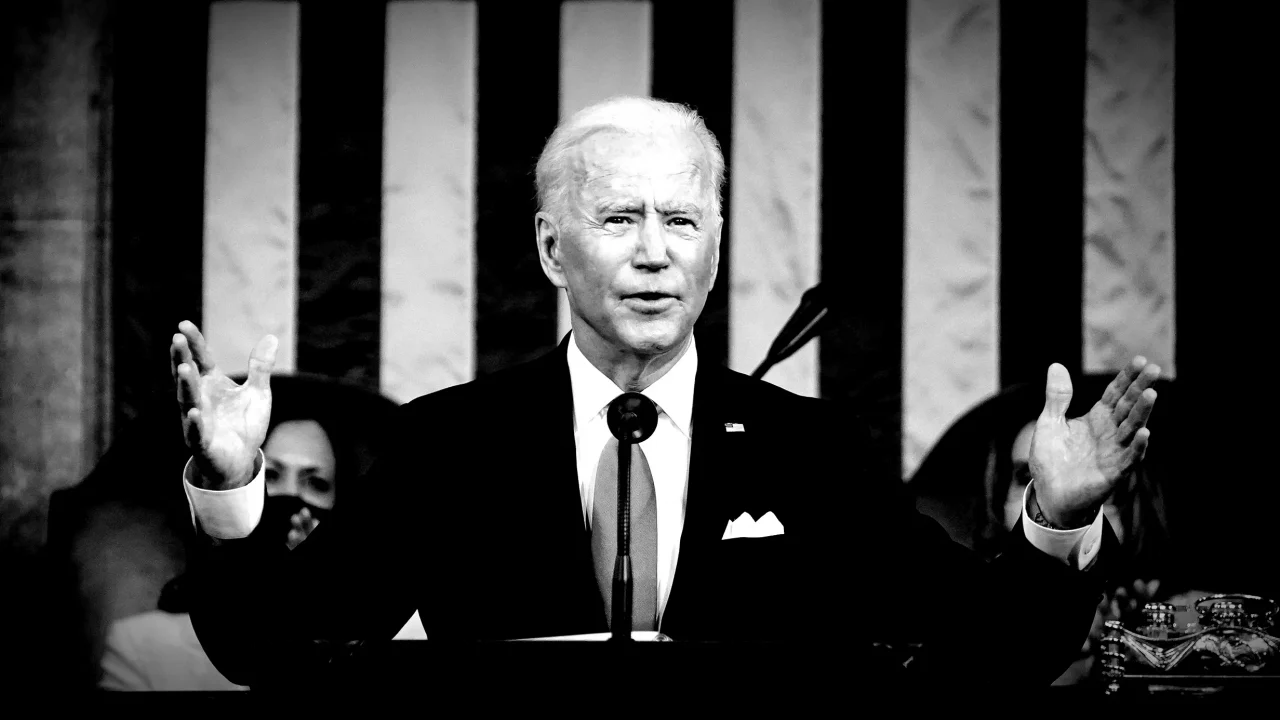

Making a protracted debt ceiling fight all the more likely is the large gap between the Republican House Majority and the Biden Administration’s opening positions over this issue. Mr. McCarthy, who is beholden to the Freedom Caucus of the Republican Party, keeps repeating that he will not agree to raising the debt ceiling without a commitment to large public spending cuts, including on Social Security and Medicare spending. He does so, knowing full well that such spending cuts are anathema to President Biden.

For his part, Mr. Biden believes that the debt ceiling should be raised without any conditions being attached since Congress had already approved the underlying spending.

A number of times in the past, when there have been large political differences over an important economic issue, entrenched political positions only changed when politicians found themselves staring over an economic abyss. This happened in 2008 over the introduction of the Troubled Asset Relief Program (TARP), which was only passed once there was a major stock market and credit market meltdown.

This would make it likely that today’s debt ceiling negotiation too will only be resolved when financial market dislocations force politicians to come to the table for fear of being blamed for inviting a deep economic recession.

In 2011, when last a debt ceiling negotiation went down to the line, US and world financial markets were roiled even though in the event a debt default was avoided. Markets were deeply troubled by the prospect that the world’s largest sovereign borrower might default on its debt obligations. Following that episode, Standard and Poor’s deprived the US government of its coveted AAA rating, which had the effect of raising the government’s borrowing costs.

Today, there is reason to believe that should the debt ceiling negotiations again go down to the wire, US and world financial market turmoil would be worse than in it was 2011. The last thing that financial markets now need are doubts about whether the US government will meet its debt obligations at a time when the world is drowning in debt and when the stock market and housing markets are already being roiled by the most rapid monetary policy tightening in the past forty years.

All of this suggests that now is certainly not the right time to be playing political games with the debt ceiling issue. By inviting financial market turmoil, such games could put a soft US economic landing out of the Federal Reserve’s reach.

We have to hope that politicians soon recognize the real economic risks of another bruising debt ceiling fight. Maybe then they would find a way to bridge the presently large gulf between their respective negotiating positions.

However, given the very narrow House majority and given how beholden both sides are to the more extreme flanks in their parties, I would not suggest betting on an early resolution of this issue.

MORE: Donald Trump Just Destroyed His 2024 Changes

MORE: The F-15EX Is No F-35

MORE: The One GOP Candidate Worse Than Donald Trump

Dr. Desmond Lachman is a senior fellow at the American Enterprise Institute. He was formerly a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging market economic strategist at Salomon Smith Barney.