Dennis Robertson, the late Cambridge economist, never tired of saying that bad economic ideas were like going to the greyhound races. If you stood still long enough, the dogs would come around the track again.

Judging by President Donald Trump’s punitive tariff action this weekend against Canada, China, and Mexico, it seems that the bad idea of starting a trade war is back again for the first time in almost one hundred years.

Like the Smoot-Hawley Act of the 1930s, these tariff measures will likely end in tears for the US and world economies.

Didn’t We Learn from Tariff History?

If there is one thing that we should have learned from the Smoot-Hawley tariff experience, it is that tariff wars are a lose-lose proposition for the world economy.

By inviting retaliation in the form of reciprocal trade restrictions, international trade gets disrupted significantly. That inflicts real pain on all countries’ export sectors.

That, in turn, imparts an adverse shock to their overall economies. Almost all economists agree that Smoot-Hawley was a significant contributor to the length and depth of the Great Economic Depression.

Undaunted by the Smoot Hawley experience, Mr. Trump has made tariffs a central part of his economic program. Barely two weeks in office, he has imposed a 25 percent import tariff on Canada and Mexico, our two largest trade partners. He has done so in flagrant violation of the United States-Mexico-Canada agreement to get those two countries to take action against the influx of illegal immigrants and fentanyl into the United States.

In addition, Mr. Trump has slapped a 10 percent tariff on China and threatened heavy levies against Europe and the rest of our trade partners.

Donald Trump’s Tariffs Are Coming at a Bad Time

While it is never a good time for the United States, the erstwhile leader of a free international trade system, to start a trade war, it is a terrible time for it to do so when many of the world’s economies are struggling.

China, the world’s second-largest economy, is amid the bursting of its housing and credit market bubble. The last thing that its slowing economy can afford is a body blow to its export sector. Meanwhile, Germany, the world’s third-largest economy, has been in recession for two years, and France is suffering from acute political dysfunction and unsustainable public finances.

Those countries, too, cannot afford a world trade war. In these circumstances, it is unwise for the United States to precipitate an economic recession in Canada, China, and Mexico by subjecting their economies to punitive tariffs.

Retaliation and Recession

A world in recession does not bode well for the United States export sector, US corporate earnings, or the US banking system with sizeable foreign loan exposure. Nor does it bode well for the US stock market, considering that around 30 percent of the S&P 500s profits are earned abroad.

As might have been expected, in response to Mr. Trump’s tariff action, Canada and Mexico are already threatening to retaliate by imposing import tariffs on sensitive parts of the US export sector. The same might be expected from China and Europe should Mr. Trump follow through on his threats of further tariff action.

That risks taking us down the economically disastrous road of the beggar-thy-neighbor policies that characterized the 1930s.

Trump’s Tariffs Could Spark More Inflation

In addition to risking a world economic recession, Mr. Trump’s tariffs will add meaningfully to inflation by raising the domestic cost of imports and food items. That will make it difficult for the Federal Reserve to resume its interest rate-cutting cycle.

One of the purported objectives of Mr. Trump’s tariff policy is to reduce the country’s large trade deficit. However, that objective will prove to be elusive, considering the significant tax cuts that Mr. Trump is proposing.

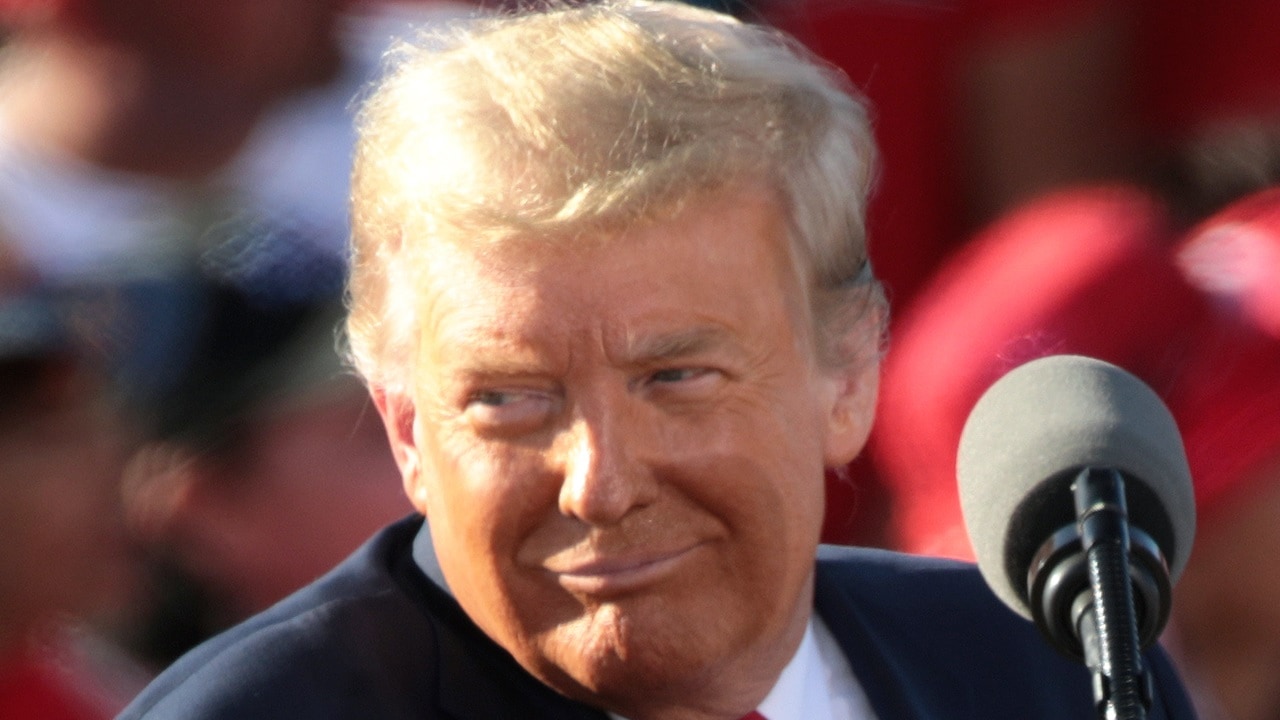

Donald Trump. Image Credit: Creative Commons.

According to the Committee for a Responsible Budget, Mr. Trump’s proposed tax cuts would add nearly $8 trillion to the budget deficit over the next decade.

By reducing national savings, those tax cuts are more than likely to cause a further widening in the trade deficit and take us back to the twin deficit problem of the 1980s.

In short, Mr. Trump has started his second term with a significant economic policy mistake. That mistake risks precipitating a world economic recession that will cause considerable harm to our economy.

At the same time, Mr. appears to have complicated the Fed’s task of meeting its 2 percent inflation target, thereby delaying the return to a world of lower interest rates. He appears to be setting himself up for a shellacking in the 2026 mid-term elections.

About the Author: Desmond Lachman

American Enterprise Institute senior fellow Dr. Desmond Lachman was a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging-market economic strategist at Salomon Smith Barney.