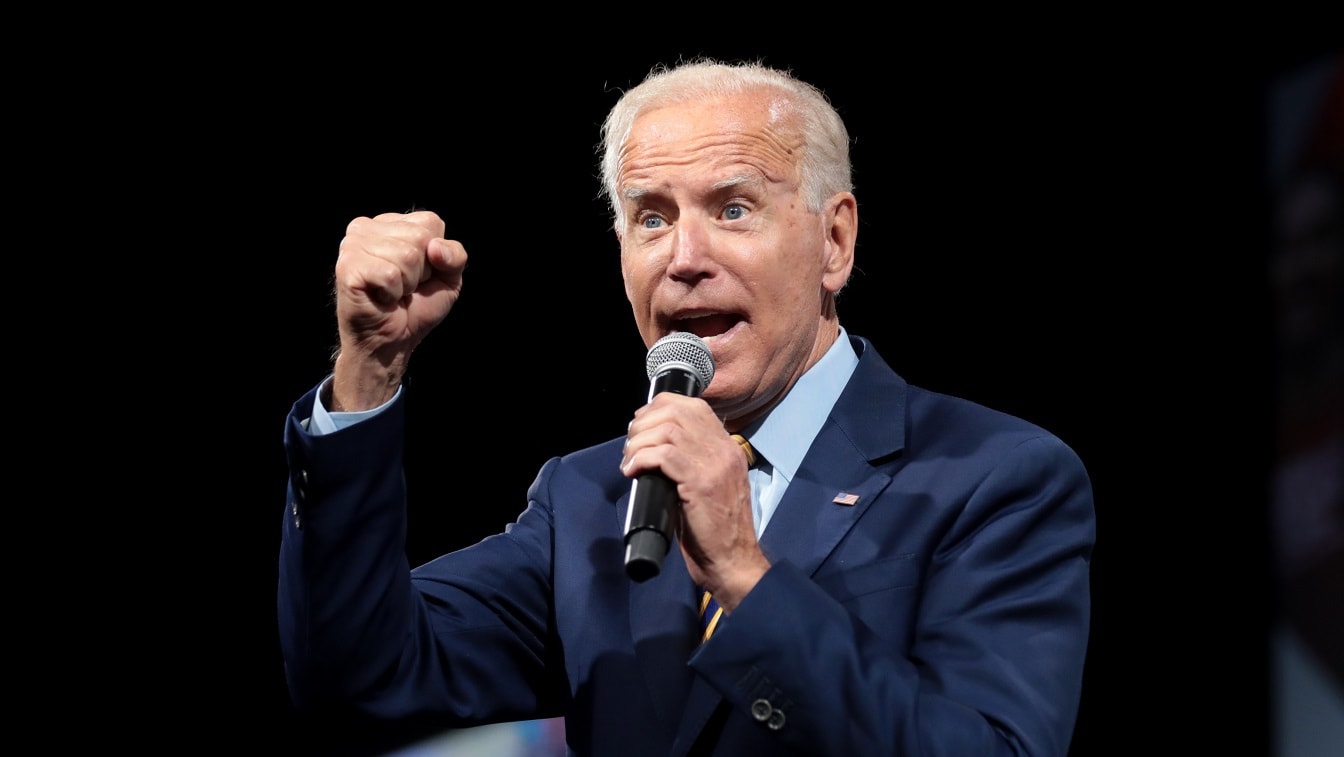

Rolling out a new student loan forgiveness program surely was a better thing for President Joe Biden to be talking about than the anniversary of the Kabul airport bombing that same week, but it hasn’t gone as swimmingly as the White House might have hoped.

One of former President Barack Obama’s top economists was scathing in his assessment of the plan, as Jason Furman blasted it as “reckless” and “[p]ouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning. Economists are still debating its inflationary impact a week later.

Democrats in competitive races did not uniformly support the plan, suggesting that they read the election-year politics differently than the White House. They could be wrong, of course, but it was not the clear-cut partisan issue Biden’s team undoubtedly anticipated.

There have even been analysis that suggests Biden’s plan will wipe out whatever savings are achieved by his so-called Inflation Reduction Act at a time when the president is clearly trying to reposition himself from big spender to Clintonian deficit reducer ahead of the midterm elections in the hope inflation will fall and he can take credit.

Biden’s apparent inability to sell a partial student loan debt cancellation to voters recalls the now politically incorrect joke about being unable to sell ice to Eskmos.

Except the politics of government spending are more complicated than the conventional wisdom holds.

When broad swathes of the electorate see a program and say, “I’m going to be getting that,” the result is often popular. When they instead react by saying, “I’m going to be paying for that,” voters may react against the latest expansion of government.

That’s the difference between welfare reform in the 1990s, when many voters perceived themselves to be footing the bill for ill-conceived programs that benefit people who do not want to work, versus Social Security or Medicare, to which taxpayers feel they have contributed over their working lives.

Many of the 60% of Americans without college degrees, graduates who have already paid off their student loans, and borrowers who are ineligible in part because the White House wanted to keep costs down do not benefit from this proposal. They will mostly see themselves as paying the freight rather than receiving a tangible benefit.

This includes many of the working-class voters Democrats are trying to win back into their column after hemorrhaging them in the recent election cycles. The Biden student loans gambit appeals more to the college-educated suburbanites the party has been winning over to compensate for the loss of these voters.

Biden’s plan also seems to resort to asking taxpayers to foot the bill rather than colleges and universities, including those with large endowments. Aside from some reasonably sketchy academic institutions, the colleges themselves are primarily left off the hook for large tuition increases.

This flies in the face of Biden’s approach to almost any other instance of rising prices. Biden has blamed big oil, big meat, big diary, mom-and-pop gas station owners, and all manner of other private sector actors this side of Russian President Vladimir Putin for inflation rather than monetary and fiscal policy. Colleges and universities do not loom particularly large in Biden’s messaging about the cost of higher education.

Neither does reforming these institutions or making them assume more of the risk on student loans, even as the Department of Education pledges to crack down on certain fly-by-night diploma factories. We’ll have to see whether any more reputable colleges that are much bigger drives of tuition costs end up being targeted in these enforcement practices.

Seems less likely than a household with an income under $400,000 being audited by the IRS.

Overall, the political calculus behind the student loan plan (as opposed to the more substantive arguments in favor of debt forgiveness in this context) appears to be goosing the turnout of younger voters in the midterm elections. This demographic tends to vote Democratic in presidential years, turns out less reliably in the midterms, and especially unenthusiastic about Biden.

The worry, particularly among Democratic skeptics of this plan, is that it will do for millennial turnout will be more than offset by repelling more committed voting blocs, even if just at the margins in a few key battleground state races.

Then there is the whole matter of inflation, which has reminded voters that government spending has real costs even when they don’t have to pay for it in direct taxes. That’s what ended Democratic electoral hegemony a generation ago. Biden is old enough to remember.

Expert Biography: A 19FortyFive Contributing Editor, James Antle III is the Washington Examiner’s politics editor. He was previously managing editor of the Daily Caller, associate editor of the American Spectator, and Editor of the American Conservative. He is the author of Devouring Freedom: Can Big Government Ever Be Stopped?