Yesterday’s intimation by the Federal Reserve that it would soon start tapering its aggressive bond-buying program, casts a dark cloud over the stock market’s likely performance in the run-up to the 2022 mid-term elections. The good news for Mr. Biden is the distinct possibility that the Fed will delay its tapering for some time. The bad news for Mr. Biden is that the likely factor that could stay the Fed’s tapering hand is an economically damaging delta wave. That in itself would be bad news for the stock market.

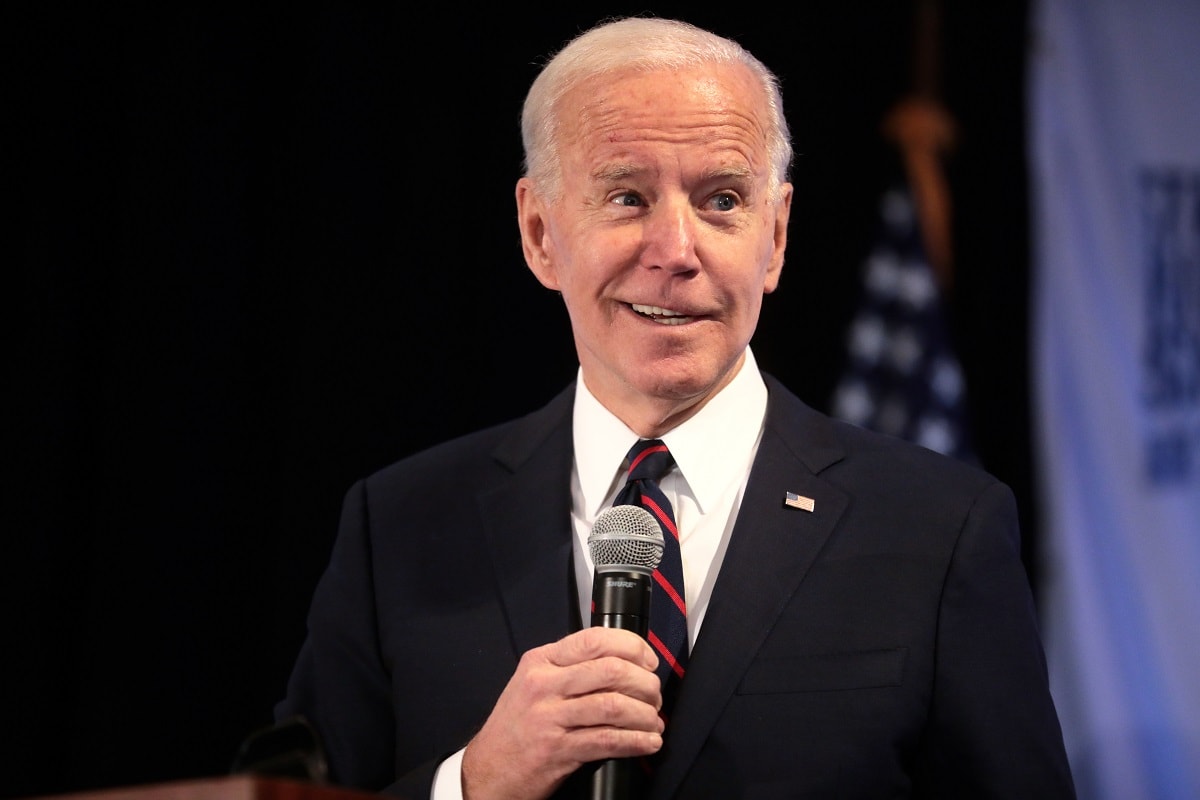

To date, the stock market has performed well under the Biden presidency. Indeed, during his first seven months in office, the S&P 500 has increased by almost 16 percent. That increase is more than double the stock market’s rebound during the comparable initial months of the Trump presidency.

The primary factor underlying Mr. Biden’s favorable stock market performance has been the continued large amount of Fed money printing. After having increased the size of its balance sheet by a staggering $4 trillion last year, the Fed has continued to buy $120 billion a month in US Treasury bonds and mortgage-backed securities.

A real risk that the Fed has created for Mr. Biden in the run-up to next year’s mid-term election is that its money printing has inflated an equity bubble that could burst on his watch. That we seem to have a stock market bubble is suggested by the fact that US equity valuations today are at around double their long-run average. It is also suggested by the fact that US equity valuations are at the loftiest of levels only experienced once before in the last one hundred years.

Making the stock market vulnerable to a sharp decline is the idea that its current strength is based on two questionable premises. The first is that today’s unusually low-interest rates will last forever. The second is that the US economy will continue to recover strongly from last year’s pandemic-induced recession.

In the context of a strongly recovering economy and the largest peacetime budget stimulus on record that has raised the risk of economic overheating, the Fed is now intimating that it might soon start tapering its bond-buying program. By so doing, it has thrown into serious question the market’s seeming belief that low-interest rates will last forever. If the Fed actually does start cutting back on its large US Treasury bond-buying program, the all-important 10-year US Treasury bond yield is bound to rise, which will almost certainly send ripples through the stock market.

The one thing that could delay Fed tapering would be a faltering of the US economic recovery as a result of a delta-induced economic lockdown. However, as happened in March 2020 with the initial Covid-19 economic lockdown, such an occurrence could throw into serious question the market’s current rosy outlook for corporate earnings’ growth. That in turn, rather than higher interest rates, could be the trigger that causes the US equity bubble to burst.

The net upshot of all of this for Mr. Biden is that in the run-up to next year’s mid-term election he would do well to be careful what he says about the stock market. Instead of crowing about the very favorable stock market performance under his watch to date, he might acknowledge that the stock market’s continued rise owes more to Fed policy of money printing than to his economic policies. Maybe then Mr. Biden will have credibility should the market indeed fall next year to point his finger at the Fed’s policies over the last few years for creating an equity bubble in the first place.

Desmond Lachman is a senior fellow at the American Enterprise Institute. He was formerly a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging market economic strategist at Salomon Smith Barney.